Slack property market takes toll on services

By ZHENG YANGPENG (China Daily) Updated: 2014-08-06 07:14

Liu noted that the official services PMI had declined for a second consecutive month. A survey by the National Bureau of Statistics found that services activity, as measured by the index, slowed to 54.2 in July from 55 in June and 55.5 in May. The official PMI is weighted more toward large State-owned enterprises.

Responding to the unexpected fall in the services PMI, the Shanghai Composite Index on Tuesday fell 0.2 percent to 2,219.95 points, after jumping 1.7 percent a day earlier.

China Vanke Co slid 2.1 percent in Shenzhen after sales dropped to 13.3 billion yuan ($2.15 billion) in July from 19.4 billion in June. Poly Real Estate Group Co retreated 1.7 percent. A measure of developers in the Shanghai index dropped 0.8 percent.

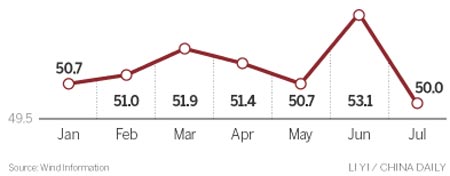

A major reason for the rally in the stock market last week was the upbeat manufacturing data. In July, both the official manufacturing PMI and the HSBC/Markit index reached their highest levels in many months. But even those numbers contained cause for concern.

A report by the macroeconomic research team at China Merchants Bank Co Ltd said despite rallying manufacturing PMI data, the recovery remained fragile. Sub-indexes of the PMI showed that companies are cautious about increasing inventories and staff, and cement and electricity production showed signs of weakness.

|

|

|

| East China city lifts home purchase limit | Housing market faces price corrections, says think tank |

- Sri Lankan calls on firms to ready for China FTA

- Beijing's office rent set to stabilize in H2

- China-style investment policy might resolve land sale row

- Two Chinese firms plan to list on Seoul bourse

- China to punish Chrysler, Audi for anti-trust violations

- China's antitrust body slaps fine on Japanese firms

- Paring off time

- Chinese solar company launches plant in S. Africa