Ruling set to burn US solar firms

By AMY HE (China Daily) Updated: 2014-12-25 08:52

|

|

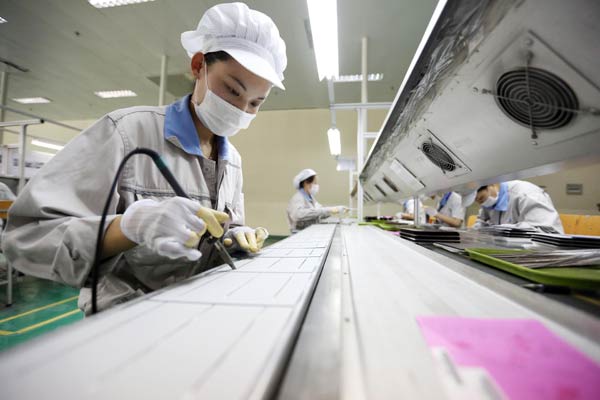

Workers at a solar panel factory in Lianyungang, Jiangsu province. The US Department of Commerce has ruled that solar products from China were dumped in the US market and manufacturers were subsidized by the government.SI WEI/CHINA DAILY |

Products from Taiwan, Chinese mainland at issue in dumping and subsidy dispute

United States-based solar manufacturers are already feeling the impact of the latest US Commerce Department decision to levy tariffs on Chinese solar exports, according to the Coalition for Affordable Solar Energy.

The decision will "undercut the growth of American solar jobs and hurt our domestic solar industry", said Jigar Shah, president of the coalition, which opposed the original petition filed by SolarWorld that led to the decision.

After the decision was announced, US manufacturers such as Suniva Inc and Hemlock Semiconductor Corp have reportedly been hurt.

Hemlock said last week that it would close a $1.2 billion plant in Tennessee due to "ongoing challenges presented by global trade disputes", according to a company statement.

The facility was never operational, but the closing would affect about 50 employees.

"As difficult as this is, the continued market adversity and complex political conditions have left no economically viable options for Hemlock Semiconductor to operate the site," said Denise Beachy, president of Hemlock Semiconductor. "It is unfortunate for both the company and the community that these conditions have forced us to take this action."

Last December, the US arm of German solar manufacturer SolarWorld filed a petition stating that the Chinese mainland manufacturers sidestepped 2012 import duties by taking production of solar products to Taiwan and then flooding the US markets with cheap goods.

SolarWorld also accused Chinese manufacturers of receiving unfair subsidies from the government.

On Dec 16, the Commerce Department released its final decision on its investigation into the antidumping and countervailing claims, saying that the solar products were dumped and that manufacturers were getting subsidies from the government.

The ruling said that products from the Chinese mainland were dumped at margins ranging from 26.71 percent to 165.04 percent, and those from Taiwan at margins from 11.45 percent to 27.55 percent.

A final determination from the International Trade Commission will come at the end of January, and if the ITC rules that there has been injury to the domestic market, then US Customs will require cash deposits for countervailing duties equal to the final subsidy rates determined by the Commerce Department.

"Given the global threat of climate change and the recent US-China commitment to reduce carbon emissions, it makes absolutely no sense to impose unproductive tariffs on solar imports that also damage US solar companies," said Shah.

The organization said that companies such as Suniva are being put in the "bizarre position of paying severe import duties on a product (photovoltaic cells) they manufactured in the US" when the cells are assembled in China.

"We continue to urge the governments of the US and China to accelerate negotiations to preserve free and fair trade in the global solar industry. Affordable solar panels are a good thing for the US, China, and the world," Shah said.

Paula Mints, chief market research analyst at SPV Market Research, said that "all energy technologies are subsidized".

There is no such thing as a "fair and even playing field", Mints said. "The people who will potentially be hurt are the buyers of modules. The installers and system integrators, the developers, they rely on the lowest cost of hardware."

- Swaps allow China to go on offensive

- China's bankers enjoy first pay hike since global financial crisis

- Shrinking margins ahead for brokerages

- China ahead of schedule with 2014 energy targets

- Chinese goods most attractive in Lebanon during holidays

- Yunfu chisels new shape for stone industry

- Surging refinery capacity creates tempest in a teapot

- Ruling set to burn US solar firms