Deals pipeline robust in 2014

By SHI JING (China Daily) Updated: 2015-01-28 08:33

|

|

Inbound, outbound contracts show steady growth in terms of numbers, value

Strategic mergers and acquisitions remained robust across all categories in China last year, said a report published by global consultancy firm PricewaterhouseCoopers.

Overall M&A activity remained high in China, with a 55 percent year-on-year growth in the number of deals and total value. A total of 6,899 deals, with a value of $407 billion, were transacted in China last year, PwC said.

The reform of State-owned enterprises and M&As among A-share companies were the main drivers for the M&A activity. The ongoing consolidation as China's domestic economy matures has also been a key driver, said Liu Yanlai, private equity leader for the Chinese mainland and Hong Kong at PwC.

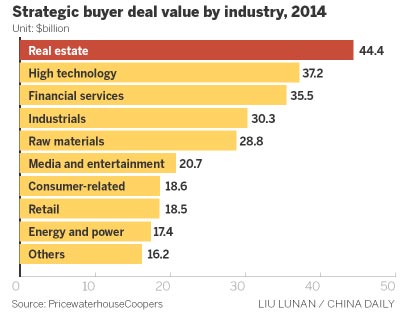

Technology, consumer-related and financial services were the most active sectors in terms of M&As, partly reflecting the development of the economy.

A total of 766 deals were recorded in the high-tech sector last year, up from 404 a year earlier. Apart from the A-share companies' growing interest in the gaming industry, the surge was propelled by the proactive giants in the Internet industry, namely Baidu Inc, Alibaba Group Holding Ltd and Tencent Holdings Ltd, said Liu.

Technology consultancy IDC said 2014 was a banner year for Alibaba in terms of M&As. The e-commerce giant invested in or acquired about 20 companies last year to restructure its business portfolio.

Deals in the financial services sector were also closely watched in 2014. The number of deals rose from 300 in 2013 to 501 in 2014, driven by the development of peer-to-peer lending platforms, online finance and mobile payment, said Liu.

Liu also said that the increased deals in the healthcare sector should be seen as a growing trend that is likely to continue due to ongoing reforms of the healthcare system.

The real estate sector attracted the biggest investment of about $44.4 billion, with several developers seeking new sources of capital.

Hong Shengqi, senior analyst at the Research Center of the China Real Estate Information Corp, said: "With Chinese property companies reporting lesser profit, there are chances of more M&As in the sector. It is also an important tool for companies to enter the market with fewer risks."

Foreign-inbound strategic M&As also hit a record high in value, reaching nearly $25 billion and was led by the increase in banking and financial services sectors.

Last year was also a banner year for new investments by private equity companies, with the announced deal volume surging 51 percent to a record of 593. The total deal value surged 101 percent to reach $73.2 billion during the same period, with several PE firms participating in the SOE reforms.

PEs also looked for overseas businesses that have a strong China-angle in their growth strategies in 2014, with the outbound deal value reaching a record of $14.3 billion.

Gabriel Wong, lead partner of China corporate finance at PwC, said the number of Chinese outbound deals surged by more than one-third to reach $56.9 billion in 2014. North America overtook Europe last year in attracting Chinese investment with 96 completed deals, mainly focusing on technology, healthcare and real estate in the East Coast of the United States.

"Privately owned enterprises continue to lead the charge, but this year we have seen that financial buyers and PEs have not only contributed to deal volume but also started to make a significant contribution to value," he said.

- Dacheng-Dentons merger creates global legal powerhouse

- Economic change weighs heavily on manufacturers

- Actress takes 9% stake in Alibaba Pictures

- Car ownership tops 154 million in China in 2014

- 9 animal logos of tech companies

- Internet firms 'must obey rules'

- Yahoo to spin off Alibaba stake into separate company

- Industrial profits dive in December