China's local governments lower sights for growth

By ZHENG YANGPENG (China Daily) Updated: 2015-01-30 07:35

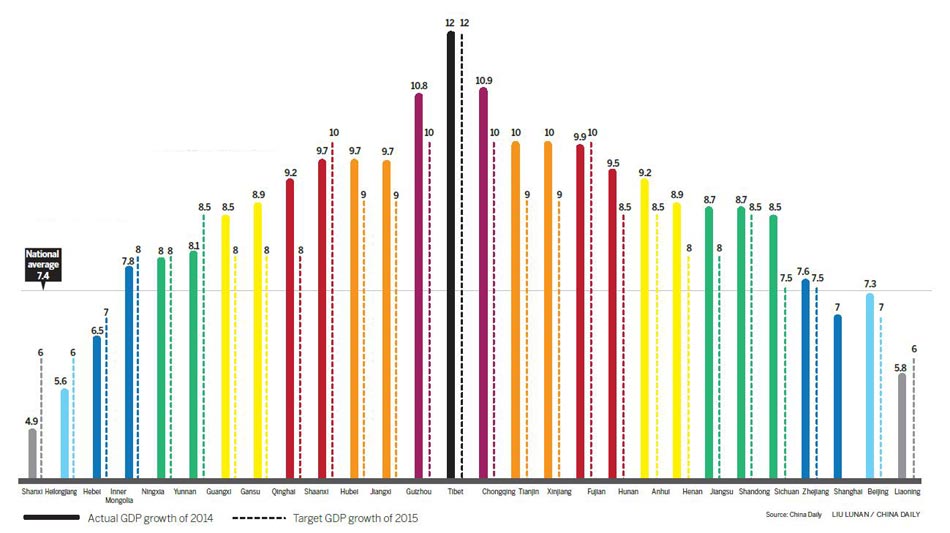

Few achieved GDP targets in 2014; resource producers, heavy industrial bases hit hardest

Virtually every provincial-level government has lowered its growth target for this year, reflecting mounting downward pressure at the local level and providing further evidence that the central government will cut the national target to 7 percent.

Of 28 provincial-level governments that have announced targets, 26 have cut their GDP growth goal by 0.5 to 3 percentage points.

Tibet kept its target at "about 12 percent", unchanged from 2014, while Shanghai decided not to set a target at all.

Several cities such as Beijing and Shanghai are independent municipalities with the legal status of a province.

The lowered expectations come as no surprise to economists, who have said that the Chinese economy will remain under pressure. Of the 28 regions that have released 2014 GDP data so far, only Tibet and Chongqing achieved their goals.

Provinces with the largest gaps between goals and reality last year were also those that slashed this year's targets the most. The northern, coal-rich Shanxi province was the slowest-expanding region last year with growth of 4.9 percent, far below its 9 percent goal. This year, it aims for GDP growth of "around 6 percent".

The situation was similar in the northeast provinces of Liaoning and Heilongjiang and in Gansu, in the northwest.

Yuan Gangming, a researcher at Tsinghua University's Institute of China and World Economy, said that indicators based on real economic activity, such as electricity consumption and railway cargo volume, implied the situation was even worse than the GDP figures.

Assuming that growth edged down 0.1 percentage point each quarter, growth would decelerate to 7 percent in the fourth quarter of this year.

"So it makes no sense for Beijing to keep the target at 7.5 percent. It would be unrealistic," said Yuan.

Citing several people with knowledge of the matter, Reuters reported on Wednesday that the closed-door Central Economic Work Conference in December set a goal for 2015 of "around 7 percent". The goal will be announced in March.

A region-by-region analysis shows how years of reliance on traditional growth engines have left many provinces adrift amid cooling aggregate demand and real estate activity.

In Shanxi, falling coal prices have crippled the resource-dependent economy, and the exposure of widespread corruption has left the bureaucracy in disarray-and in no mood to face economic woes.

Three provinces in the northeast were hit hard. Growth in Liaoning, a manufacturing stronghold that grew rapidly in previous years, faltered to 5.8 percent last year, the second-lowest in China.

Heilongjiang, a stronghold of heavy industry (especially oil), grew only 5.6 percent. The province has decided to cut annual oil output by 1.5 million metric tons. Combined with slumping oil prices, any chance of recovery is dim for the province.

"The situation in the northeast and Shanxi shows us what a real 'hard landing' looks like. It also lays bare the shortcomings of the traditional growth model," said Liu Qiao, a professor of finance at the Guanghua School of Management at Peking University.

He said leaders of these regions should reflect on their traditional approach, patiently seek new growth sources and refrain from pump-priming via big infrastructure projects.

Nationally, however, there is some rationale for short-term stimulus, he said.

"Growth can be improved by raising the investment ratio or improving investment efficiency. The latter is hard to achieve in the short term. So boosting the investment ratio is expedient in preventing a sharp fall," he said.

Yuan took a dim view of infrastructure investment-based stimulus. Easier monetary conditions, especially faster growth in broad money supply, would be a better favorable tool, he said.

Liu joined many economists in calling for the outright abandonment of GDP growth targets. He said a number should be set as a "forecast", rather than a mandate to fulfill.

- Market reforms reshape China's economic landscape

- China Railway International seeks investment opportunity in Cambodia

- China's coal output suffers record fall last year

- China lifts overseas online shopping transaction limit

- Gree seeks sustainable growth in a slowing market

- China steel industry struggles

- China's railway investment tops 800b yuan

- Macao casino operator Sands China Q4 profit drops 15%