The dark side of China's offshore investment

By Ed Zhang (China Daily) Updated: 2015-02-02 10:55Weighing up all the factors at work, China's domestic economy will most likely be OK in 2015. There will be some areas, like Internet-based small enterprises, that will probably see great progress. But there will be a dark side. And that will be about the money.

It is not that Chinese companies are short of working capital or investment. The country is right now one of the few economies with an abundance of money. The government has allowed small private lenders to spring up like mushrooms. It is much easier for competitive businesses to be approached by private equity and venture capital fund managers, from Beijing and Shanghai to Shenzhen.

It is not that the securities market will collapse. The Chinese market may be more volatile than anywhere else. But if, as Premier Li Keqiang said last week, the country is still to create more than 10 million off-farm jobs, then its overall growth rate can't be allowed to drop by much, and at least some of the listed companies will be government-led investment projects.

Neither is it that some local governments, or companies serving as local government financial vehicles, will default on their loans and declare bankruptcy, even though the amount of local government debts is dangerously high. There is no doubt that some local projects will be discontinued, if not abandoned.

At the very least, every local government has a few newly built and expensively furnished office towers. They can be sold to private investors to be converted into hospitals and schools-to at least generate the money to fund the government's daily functioning.

Since the 1990s, China has been an expert in postponing a full-fledged domestic economic crisis, and in the process, either mitigated or suppressed its would-be impact.

The biggest uncertainty, however, lies outside China, in the financial validity of its long-term commitments across the globe. This is because, in overseas investment, China is still a new player and has yet to be equipped with enough experience and skills.

Since more than half a century ago, China has tended to see its outbound investment not as a pure economic activity, but as a mixture blended with political significance, say a kind of friendship with humanitarian aid benefits, to countries that were ignored by the traditional major powers of the world.

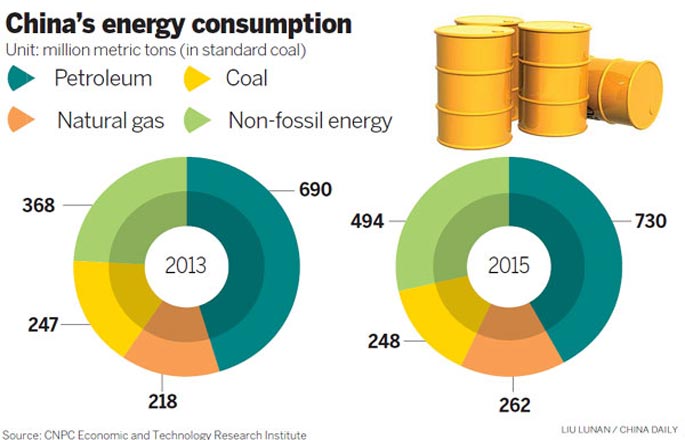

Since the outbreak of the global financial crisis in 2008, thanks to China's rich export income and dollar reserve, it has invested quite ambitiously in some overseas assets, from energy and mineral resources to logistic infrastructure. But now, with changing global market prices-partly because of a change in China's own demand structure-and changing politics in recipient countries, some of that investment is in danger of being wasted.

- China sketches out priorities of 'Belt and Road' initiatives

- China to speed up agri modernization through reforms, innovations

- Slowing economy crimps China's fiscal revenue

- China has growth potential: McKinsey expert

- Market reforms reshape China's economic landscape

- Cities cut GDP growth targets to adapt 'new normal'

- Jan FDI inflow jumps 29.4%

- Australian seafood gets wings

- Alibaba: SEC seeking information on fight over fake goods

- Ready to wear

- Cut-price parallel-imported vehicles could curb hefty price

- Young Chinese talent put in incubator in UK

- Changan Ford responds to Chinese customers' wants

- Alipay launches new service to counter WeChat block