COFCO's Ning to lead Sinochem for international growth

By Zhong Nan (China Daily) Updated: 2016-01-06 08:35

COFCO's Ning shifts from top food trader to drive Sinochem's international growth

The administrator of China's central State-owned enterprises announced a personnel reshuffle on Tuesday which is aimed at giving further impetus to the global expansion of one of the nation's top chemical firms.

The State-owned Assets Supervision and Administration Commission said 57-year-old Ning Gaoning, former head of COFCO, will become new chairman of Sinochem Group.

|

|

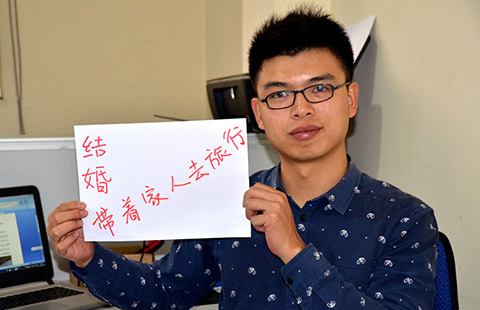

Ning Gaoning, new chairman of Sinochem Group [Photo/China Daily] |

The commission said that Zhao Shuanglian, chairman of China Grain Reserves Corp, will become the head of China National Cereals, Oils and Foodstuffs Corp.

Zhao, 58, has served as chairman of Sinograin, the country's largest and most wide-ranging grain storage and transportation company since 2013.

During Ning's 11-year tenure, COFCO has developed businesses related to growing grain, food processing, maritime transportation for commodities and real estate.

Its branded products include Great Wall wines and Joy City shopping malls throughout a number of cities in the country.

COFCO had total assets of $71.9 billion and revenue of $71.8 billion in 2014, half coming from businesses in 140 countries and regions, according to the company's financial report.

Ding Lixin, a researcher at the Chinese Academy of Agricultural Sciences in Beijing, said Ning has experience in overseas merger and acquisition deals.

The central government is hoping that Ning can help Sinochem enhance its step to acquire more quality global companies.

Sinochem has businesses in a wide range of fields, from chemicals and crude oil to agricultural products and real estate. Its financial report for 2014 showed that it had total assets of 355.4 billion yuan ($54.48 billion) and revenue of 496.8 billion yuan.

Eager to enhance its earning ability in the global market, Sinochem has been keen to acquire quality manufacturers and cooperate with energy companies in Europe, Africa and South America over the past three years.

|

|

Zhao Shuanglian, new head of COFCO [Photo/China Daily] |

Wang Zhimin, a professor at the Beijing-based China Agricultural University, said the move highlights government's willingness to secure ownership of more industrial and energy companies overseas, further cast off the constraints on domestic production and dependence on imports, especially for high-end chemical and petrifaction technologies and products.

With a total spending of $750 million, COFCO took full control of Noble Agri Ltd, after buying the remaining 49 percent of the company still owned by Noble Group, the Hong Kong-based global supply chain manager.

COFCO bought 51 percent of Noble Agri in 2014, and since then has been actively engaged in resource consolidation to optimize asset allocation and boost its profitability.

It also spent $2.8 billion on a 51 percent stake in the Netherlands-based grain trader Nidera BV in February 2014.

- Time for cleaner, more creative thinking on air filters

- Taking a shine to the Kiwi grapes

- Retail sales of wine to shrink, only to swell from 2017

- CREC buys 24% stake in cash-strapped Malaysian real estate project

- Stocks eke out gains amid State-backed buying

- COFCO's Ning to lead Sinochem for international growth

- SPD Bank reveals good performance

- Highlights of CES 2016