Central bank pumps 40b yuan into market

(Xinhua) Updated: 2016-06-06 16:21BEIJING - China's central bank on Monday pumped more money into the market to ease a liquidity strain.

The People's Bank of China (PBOC) conducted 40 billion yuan ($6.1 billion) in seven-day reverse repurchase agreements (repo), a process in which central banks purchase securities from banks with an agreement to resell them in the future.

The reverse repo was priced to yield 2.25 percent, unchanged from Friday's injection of 40 billion yuan, according to a PBOC statement.

The move followed a net injection of 70 billion yuan and 95 billion yuan into the financial system on Thursday and Wednesday, respectively.

- Former senior executive of China Development Bank under probe

- Central bank pumps 40b yuan into market

- Retail giant Suning buys 70% share in Inter Milan for $300m

- China Merchants Holdings records almost 9% growth in container throughput from Jan to May

- A glimpse at the career lives of the 20-something

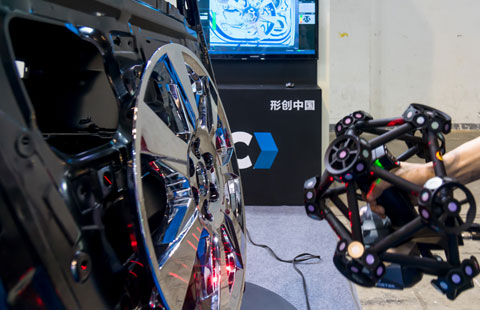

- China tech company to boost production

- Officials, experts discuss wealth management in Qingdao

- Most imported toys sold online are substandard: CCTV

Hot Topics

Editor's Picks