Chinese yuan weakens to 6.686 against US dollar Monday

(Xinhua) Updated: 2016-07-25 14:38BEIJING - The central parity rate of the Chinese currency renminbi, or the yuan, weakened 191 basis points to 6.6860 against the US dollar Monday, according to the China Foreign Exchange Trading System.

The decline came after the currency witnessed sharp fluctuations in the previous week.

On July 19, the central parity rate of the yuan weakened to 6.6971 against the US dollar, the weakest level in five and a half years, before the currency strengthened for three days in a row.

Chinese central bank Governor Zhou Xiaochuan said Sunday that China will continuously promote policy transparency and make policy more rule-based, while increasing communication with the market.

Following an adaptive phase, market participants now have a deeper understanding of the renminbi exchange rate formation mechanism, said Zhou during the G20 finance ministers and central bank governors' meeting held in the southwest Chinese city of Chengdu over the weekend.

"Currently, the renminbi remains at a basically stable level against a basket of currencies, and market confidence has been strengthened further," he added.

Chinese officials and economists have reassured markets that there is no basis for the renminbi to suffer a continuous and sharp depreciation.

China's foreign exchange reserves increased by $13.43 billion in June from the previous month to $3.21 trillion, central bank data showed on July 7.

In China's spot foreign exchange market, the yuan is allowed to rise or fall by 2 percent from the central parity rate each trading day.

- Chinese yuan weakens to 6.686 against US dollar Monday

- Broad steps needed to sustain inclusive growth: G20 officials

- UK explores free trade deal with China

- 12 Chinese firms debuted in Fortune 500

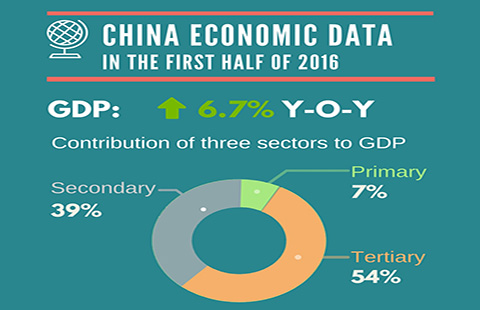

- Infographics: China economy data in H1

- Sunny images of 60-year-old go viral

- China's top sovereign wealth fund quadruples in total assets in 8 years

- Standards for smart driving on the way