Grand Chip weighs options on revoked Aixtron approval

Fujian Grand Chip Investment Fund LP said on Tuesday that the German government's move to withdraw approval of its takeover of German chip equipment maker Aixtron SE did not necessarily mean it would scrap its bid.

"The bidder is currently examining the legal implications of the letter in which the Economy Ministry withdrew the clearance certificate," said Grand Chip Investment GmbH, the takeover vehicle of the Chinese investment fund controlled by businessman Liu Zhendong.

Aixtron said on Monday that Berlin had withdrawn its approval and would review the deal, throwing up an unexpected hurdle for the 670-million-euro ($728 million) deal on the home stretch.

According to FGC, the German ministry cited information indicating that Aixtron had technology that was relevant to security, especially to the defense sector, which could be exposed in a takeover.

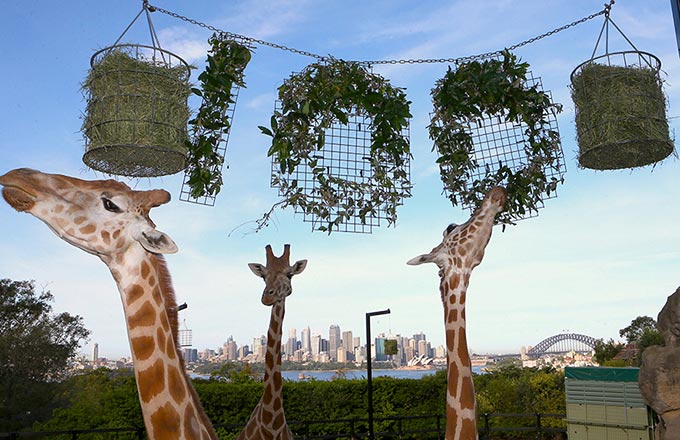

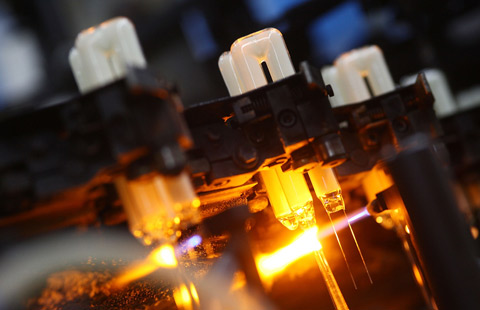

It did not provide further details. Aixtron makes machines used in the production of red, blue, green and white light emitting diodes, but also makes products for the manufacture of memory chips, power management and nanomaterials.

The government's move comes as protectionist noises from Berlin grow louder and just a week before Economy Minister Sigmar Gabriel is due to travel to China with a business delegation.

The German government cleared the deal on Sept 8.

The decision to rescind the approval was based on "previously unknown security-related information", Germany's Deputy Economy Minister Matthias Machnig told German daily newspaper Die Welt, without being more specific.

There is rising concern over whether the government should do more to protect strategic technologies following a series of bids for German companies by Chinese investors this year.

In the 4.5-billion-euro takeover of German industrial robot maker Kuka AG by Chinese household appliance maker Midea Group earlier this year, Berlin initially sought a deal to limit Midea's stake to 49 percent.

It had wanted to curb the Chinese company's influence on what it viewed as a national champion in its push to digitalize German industry, but eventually allowed the takeover after major German shareholders in Kuka sold their stakes to Midea.

Under German law, the government can block takeovers only if they jeopardize energy security, defense or financial stability.

REUTERS