China, EU talking investment

By Li Jiabao (China Daily) Updated: 2014-01-22 07:17

"The current level of bilateral investment between the EU and China is way below what could be expected from two of the most important economic blocs on the planet. Whereas goods and services traded between the EU and China are worth well over billion euros every day, just 2.1 percent of overall EU foreign direct investment is in China," said John Clancy, EU Trade spokesman.

"The main purpose for these negotiations is the progressive abolition of restrictions on trade and foreign direct investment and to improve access to the Chinese market for EU investors."

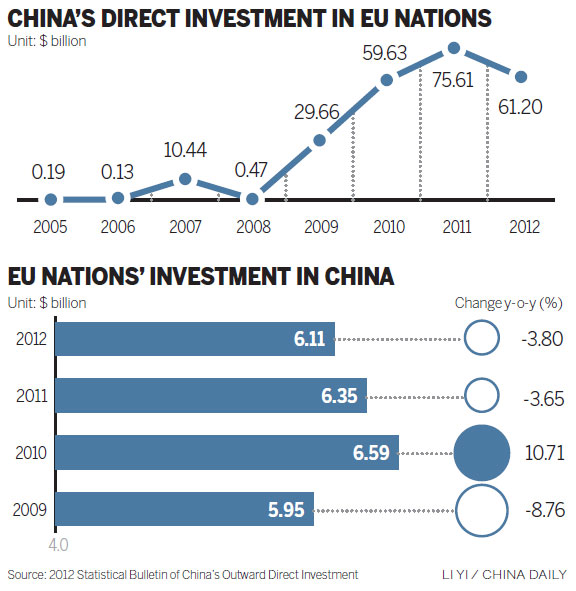

China-EU investment flows show great untapped potential, especially considering the size of the two respective economies. China accounts for just 2 to 3 percent of overall European investments abroad, whereas Chinese investments in Europe are rising, but from an even lower base.

In 2013, the EU's investment in China, not including financial sectors, rose 18.07 percent year-on-year to $7.21 billion, while China's investment in the bloc declined 13.6 percent year-on-year.

Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a think tank of the Ministry of Commerce, said the China-EU investment pact talks will proceed with "much difficulty".

"The negotiation is based on a new starting point with the adoption of a 'negative list', which specifies bans and restrictions on types of foreign investments," Huo said.

China and the United States restarted the negotiations for a bilateral investment treaty in July 2013, when China agreed that every sector would come up for discussion unless restricted by a "negative list", and foreign enterprises would be given "pre-establishment national treatment", or treated the same as domestic companies. Both sides set down the modalities, the procedures, for the negotiations during the latest round of talks held in Shanghai from Jan 14 to 15.

"China is confronted with challenges in both investment negotiations, and the key problem is how to determine and actualize the 'negative list', which is related to the degree of the opening-up of the domestic market, the services sectors and the relaxing of market access," Huo said.

He called for the approach of the "negative list" to be introduced in broader regions rather than piloted only in the China (Shanghai) Free Trade Pilot Zone.

Shen, the commerce ministry spokesman, said as the Chinese government steps up the revision of outward direct investment regulations, all the outward investments will be managed through registration. Approvals will be reserved only for investments in sensitive regions or sectors.

China pledged to expand outward direct investment by enterprises and individuals and reform the management mechanism in November. The ministry is an important force in advancing the reforms.

Shen also noted that China and the EU share much bigger complementary industrial elements than competitiveness and both sides have the capability and acumen to control trade frictions.

The EU is China's largest trade partner. Bilateral trade hit $559.06 billion in 2013, up 2.1 percent year-on-year, said the ministry. China is the EU's biggest source of imports and has also become one of the EU's fastest-growing export markets. But bilateral trade in services amounted to just 10 percent of total trade in goods. Of the EU's exports to China, only 20 percent are in services, said the European Commission.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday