|

|

|

TaiKoo Hui is a hub for luxury brands in Guangzhou. The retail occupancy rate of its mixed-use commercial properties is now almost 99 percent and that for its offices is close to 80 percent. [Photo/China Daily] |

Developer looks to residential sector and second-tier cities to promote further growth

When Swire Properties, a Hong Kong-based developer of mixed-use commercial properties, established its office in Guangzhou in 2001, it also began construction of its first commercial project on the mainland.

However, it took almost 10 years for the company to finish TaiKoo Hui, a flagship property for the company on the mainland. It covers a total gross floor of 358,000 square meters and consists of retail and office elements, a hotel and a cultural center.

"It took too long for us to finish the project. We made some mistakes during that period," said Guy Bradley, CEO of Swire Properties Chinese Mainland.

Bradley called TaiKoo Hui "a learning project" for Swire Properties, saying: "I think every company has a learning project after it comes to China."

Early media reports said the company encountered problems in negotiations with the local government on building a subway station at TaiKoo Hui.

"Something must have been wrong with the Guangzhou project because both people from the partners and our teams and government officials involved in the project changed positions over the last decade. We didn't know how to be more effective locally at that time," Bradley said.

Swire Properties has a 97 percent stake in TaiKoo Hui, which is located in the Tianhe central business district of Guangzhou, the capital of Guangdong province.

"The only good news is that we bought the land for a very low price 10 years ago. We need to make sure we will not repeat the same mistakes in our future projects," he said.

Learning from the project, Swire Properties has changed its business model, now teaming up with local developers. "The operation enables us to use the expertise of both sides to complete projects more quickly and more efficiently," he said.

The company's two new projects - Beijing Indigo and Chengdu Daci Temple - are joint ventures with domestic developers Sino-Ocean Land. And another Shanghai project is a joint venture with HKR International.

"The latest project Indigo, which just opened in Beijing last year, took less than four years to complete. The Chengdu project will be finished this year. We bought the land at the end of 2010," Bradley said.

Career in Swire

Bradley has been working in the Swire group for more than 24 years at management positions in various divisions in different nations and regions, including Papua New Guinea, Japan, Hong Kong, the United States, Taiwan, Vietnam and the Middle East.

After moving across to Swire Properties in 2006, he assumed his current role in 2011.

Recalling his first 10 years in the conglomerate - working for Swire Coca-Cola Beverage, Bradley said: "That's the footprint for Swire Coca-Cola. I ran the franchise in Fujian province. The beverage business gave me a very good experience in how to live and work in China."

The beverage business also gave Bradley an impression of what he called "the real China".

"It is quite useful because we were on the streets dealing with small shops and checking transportation work and warehouse operations. It's the real China. I also went to Jiangsu for three months during that period, visiting every corner of the province," he said.

Bradley said he is now in the most exciting business of his career because China offers huge business opportunities for Swire Properties. "There is no place I would rather be at this moment. This is where I want to be working. This is a story for business," he said.

Chinese commercial and mixed-use properties are lucrative to investors. In 2010, en bloc real estate investment reached a record $15.02 billion, up 34.6 percent compared with the year before, a Jones Lang LaSalle report said. This is in sharp contrast with the weakened property market in the United States and Europe, which are still suffering from the fallout of the global financial crisis.

"The interest in commercial properties was also triggered by the central government's tough restrictions on residential property trading, which diverted capital into the commercial sector, especially in first-tier cities," said Qin Hong, director of the policy research center affiliated with the Ministry of Housing and Urban-Rural Development.

New idea

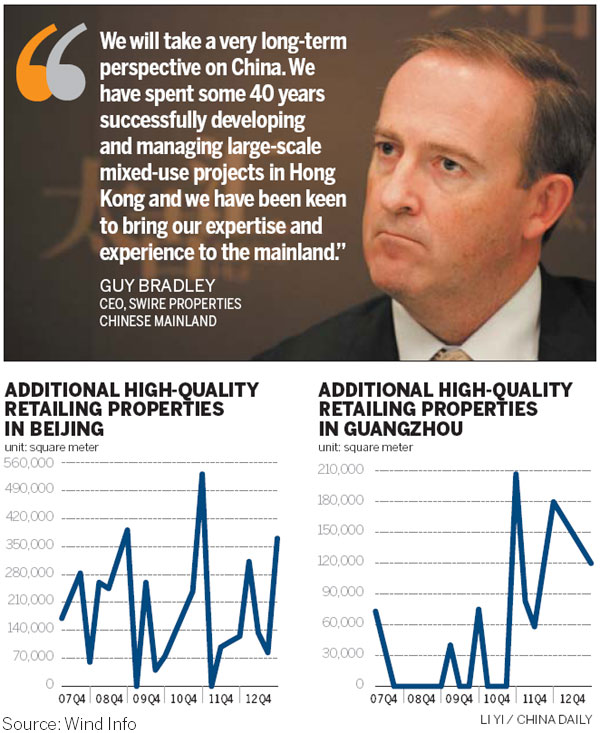

"We will take a very long-term perspective on China. We have spent some 40 years successfully developing and managing large-scale mixed-use projects in Hong Kong and we have been keen to bring our expertise and experience to the mainland," Bradley said.

Concerning the current economic downturn, Bradley said it has had little impact on the group's business in China: TaiKoo Hui in Guangzhou and Indigo and Sanlitun Village in Beijing have been moving in the right direction.

On TaiKoo Hui, the retail occupancy rate is now almost 99 percent and that for its offices is close to 80 percent. "But this year the commercial area is slowing globally, even in China. All of us (developers) can see the slowing business through the sales figures," he said.

Most cities in China continued to exhibit positive rental growth in high-end commercial projects in the third quarter of 2012, according to Colliers International, a global real estate service. The average office rent in China registered an increase of 2.3 percent in the third quarter.

"Sales are down across the whole year but don't forget it is a slower rate of growth. That means the business is still growing. In Europe right now, they can't see such growth," said Bradley.

Swire Properties' portfolio on the mainland currently amounts to approximately 1.2 million square meters in gross floor area, with five projects under development or finished. Its total projected investment on the mainland is about 30 billion yuan.

Besides the current properties in Beijing, Shanghai, Guangzhou and Chengdu, the company is also looking for locations in other lower-tier cities, according to Bradley.

"The existing offices are regionally based in the north, south, east and west. But we are not just thinking about the four cities. We are looking for significant and higher-opportunity locations in second-tier cities," he said.

Bradley's confidence in the company's future growth comes from China's speeding urbanization.

Urbanization will be the main driver of economic growth for the future, Vice-Premier Li Keqiang said at a recent meeting discussing reform. He said that domestic demand, especially from unprecedented urbanization, will overtake exports to become the main growth engine for China's future economy.

Large-scale urbanization and related development projects are likely to drive China's GDP growth to 8.4 percent in 2013, according to the World Bank.

Due to weakening exports and the government's efforts to cool the real estate sector, GDP grew 7.8 percent last year, the slowest since 1999, sources with the National Bureau of Statistics said.

"Most of the tough measures are targeting the residential sector. Actually we support any measures that will help create a more stable market, although we are not involved in residential projects," Bradley said.

However, he told China Daily that the company is also looking for opportunities to develop residential projects in China.

"You know that in Hong Kong we have developed a very good name in the high-end residential sector so we've been looking to do some similarly high-end projects here," he said.

Bradley said the company will introduce a more local business model to develop residential projects. "Probably, the first time we do it we will combine residential with retail... which is a very common approach by local developers," he said.

"If we do residential, we will have retail components, which can help feed each other. We need to find the right location and pay the right amount for the land," said Bradley, without revealing a time schedule.

China will strictly implement and improve tightening measures on the housing market and keep the policies continuous and steady, said China's State Council recently.

Is it a right time for Swire Properties to enter the market? Bradley said: "I can only say that we've been getting ready for that."

qiuquanlin@chinadaily.com.cn