London's efforts to develop an offshore yuan market began in 2011 when the then Chinese vice-premier Wang Qishan had welcomed private-sector initiatives for such a market during his meetings with British Chancellor George Osborne.

Since then, Chinese and international banks have developed a range of yuan products in London and the city's yuan liquidity has grown quickly. To strengthen activities, the Chinese and UK central banks established a yuan swap line in June.

Gifford says much progress is visible in London's yuan development, but it is crucial to build up public awareness and the practice of invoicing in yuan for trade.

"People have to learn that they can invoice in another currency," he says. "The Chinese banks play an active role in telling companies how to invoice in the yuan."

He says this education is greatly needed in medium-sized and large businesses that are big enough to do trade with China but not big enough to fully appreciate the benefits of invoicing in yuan.

"We are actively working with corporates to persuade them," Gifford says of his team at the City of London. "We have programs and information we send to them to help them understand."

Gifford was born in St Andrews in Scotland in 1955. After graduating from Oxford, he joined the investment bank SG Warburg in 1978, and in 1982 joined the Swedish financial group Skandinaviska Enskilda Bank, becoming its UK country manager in 2000.

It was Gifford's role at SEB that first took him to China, where the bank only had a representative office.

He remarks that China's financial landscape is very different now, although further reform is yet to come.

"(China's speed of reform) is certainly reasonable. Therefore because it is reasonable, it is right. We would encourage it to come quickly, but if it comes too quickly it can produce mistakes," Gifford warns.

"It's a procedure which will take many years. As China grows, China will have an interest to bring in foreign investors and businesses. This will be easier if standards are the same."

Asia Bike Trade Show kicks off in Nanjing

Asia Bike Trade Show kicks off in Nanjing

Student makes race car for 4th Formula SAE of China

Student makes race car for 4th Formula SAE of China

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

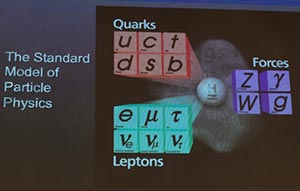

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists