Tencent takes over top slot in Asia

By Meng Jing (China Daily) Updated: 2015-09-10 07:27

|

|

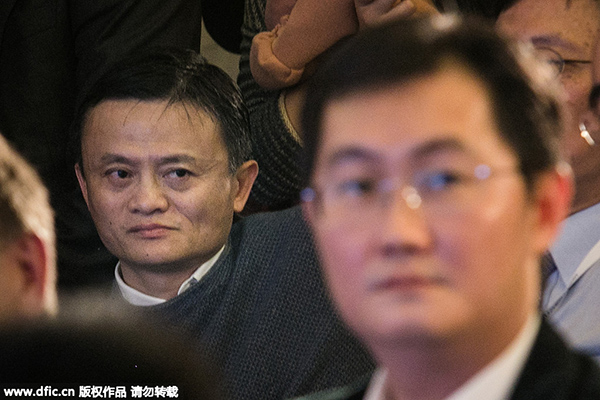

Jack Ma (left), chairman of Alibaba Group and Pony Ma (right), chairman and CEO of Tencent Holdings Ltd, at the First World Internet Conference, also known as Wuzhen Summit, in Wuzhen, an ancient town in Tongxiang city, East China's Zhejiang province, Nov 19, 2014. [Photo/IC] |

E-commerce giant Alibaba Group Holding Ltd has conceded the top slot in the Asian Internet market to rival Tencent Holdings Ltd after a slump in share prices sliced nearly $140.7 billion off its market value in the last 10 months.

The New York-listed Alibaba saw its market value fall below $153 billion after its shares closed at $60.91 on Tuesday, compared with $162 billion as of Wednesday for Tencent.

Jack Ma, founder and chairman of the Hangzhou-based company, however, allayed fears over the fall in market value and said it was "meaningless to care about share prices".

"Can jumping off a building boost share prices? No. So why don't we focus on the real business," he said on Tuesday at a conference in Xiamen, Fujian province.

Ma said rather than focusing on shareholders, the company should focus on taking good care of customers and employees. "Share prices will automatically rise once we achieve this," he said.

Alibaba, which generates more than 80 percent of its revenue from online shopping, has fallen below its IPO price of $68 for six trading days in a row since Aug 24.

The plunging share prices have also eroded Ma's personal wealth.

Ma, who holds 7.8 percent of Alibaba, has seen his personal wealth reduce by $1.4 billion compared with August 21.

Analysts said the hit taken by Alibaba in New York is more a reflection of the general challenge faced by firms in China, rather than a unique situation faced by the e-commerce company alone.

Tian Hou, an analyst with Beijing-based TH Capital, said most of the US-listed firms have fared badly due to the renminbi depreciation.

- Didi Kuaidi raises $3b in funding

- Lenovo gets ready to steal Apple's thunder

- China shaping up as 'even stronger powerhouse'

- Bigger iPad announced at Apple 'monster' event

- Tencent takes over top slot in Asia

- GDP will now rely on single-quarter data

- Apple unveils new iPhone 6S, Apple TV and iPad Pro

- Li sees stable, healthy financial market ahead