|

BIZCHINA> Top Biz News

|

|

Related

Coal shares lead fall in benchmark index

(China Daily/Agencies)

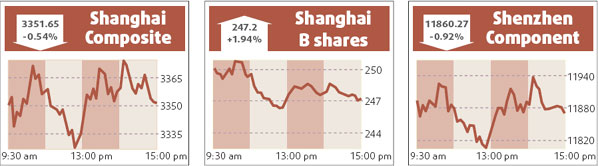

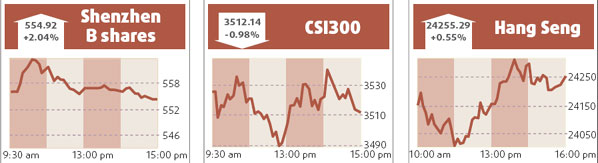

Updated: 2008-06-06 11:29   Shanghai stocks mostly fell yesterday, led by coal shares after Shandong province introduced a temporary price cut for some thermal coal, but a late surge in oil refiners and brokerages lifted the main index off its low. The benchmark Shanghai Composite Index ended down 0.54 percent at 3351.645 points, off the morning's low of 3326.537, in very thin trade. Turnover in Shanghai A shares shrank to 52.8 billion yuan (about $7.54 billion), its lowest level since last November. Shandong-based Yanzhou Coal Mining, China's third biggest coal producer, tumbled 9.26 percent to 21.38 yuan in response to Shandong's move, which aims to ensure power supplies during the summer peak season. Steel shares were weak as investors worried that official price intervention might spread to other industries. Baoshan Iron & Steel slid 3.43 percent to 11.55 yuan after the China Securities Journal reported it had notified customers of steel product price hikes for the third quarter. But oil refiner Sinopec surged 2.52 percent to 13.81 yuan on hopes that falling global crude oil prices would help its margins. Brokerages also rose sharply, with Haitong Securities up 6.17 percent to 25.46 yuan, apparently on renewed speculation that the market's weakness might prompt authorities to implement market-friendly reforms such as the introduction of margin trading and securities lending. "The rebound triggered by the cut in the trading tax in April has well and truly ended, so the market may be heading down to form a double bottom," said Zhang Yanbing, analyst at Zheshang Securities. HK shares up Hong Kong shares closed up 0.55 percent yesterday, supported by gains in telecom stocks after a two-day slide and led by a 4.4 percent jump in oil refiner Sinopec Corp and advances in local blue chips. Gains were trimmed by a 2.1 percent fall in CNOOC on retreating crude oil prices and a 3.9 percent drop in COSCO Pacific amid a lack of clarity in its bid to buy some concession rights at Greece's Piraeus Port. The benchmark Hang Seng Index closed 132.04 points higher at 24255.29 after testing the 24000 level in the morning session. Advances on the index were shored up by a 0.9 percent gain in index heavyweight HSBC Holdings and a 0.6 percent rise in China Mobile. Turnover on the main board fell to HK$63.7 billion from HK$78.91 billion on Wednesday. (For more biz stories, please visit Industries)

|