|

BIZCHINA> Top Biz News

|

|

Shanghai copper recovers

(China Daily/agencies)

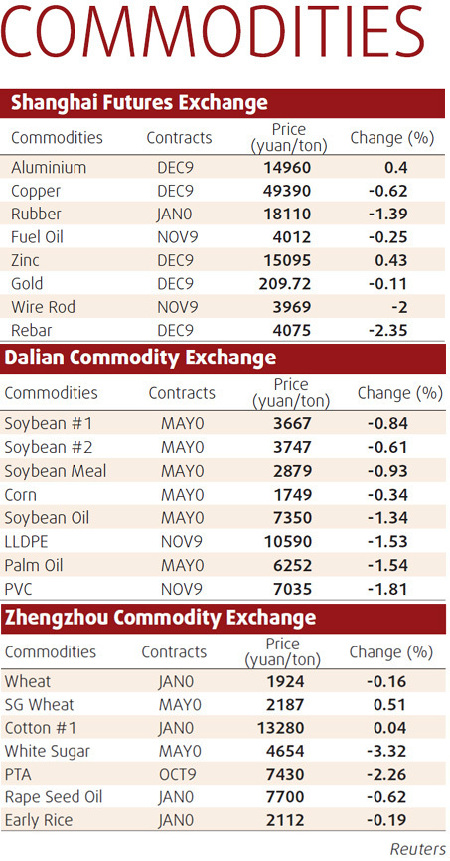

Updated: 2009-09-02 08:05 Commodity markets got off to a steadier start yesterday, as the sell-off in the previous session gave way to cautious optimism after equity markets stabilized on supportive Chinese manufacturing data. But the reprieve, which also stemmed from longer term investment fund buying, may be short-lived if China, worried about the surge in commodity markets this year, continues its attempts to cool the sector. With prices of oil, copper and lead all up 100 percent since the early part of 2009 and many other industrial raw materials up by double-digit percentages, except for grains, China may be trying to take some of the heat out of markets. "China is a bit concerned about high commodity prices so they are rattling the cage so speculators rethink their investment strategies," said Jonathan Barratt, managing director, Commodity Broking Services. "But to push things lower we need shocks and the moves in Chinese equities provide just that."

London Metal Exchange copper for delivery in three months MCU3 fell $131 a ton to $6,344 by 0654 GMT, after a 3 percent slide in Shanghai metal and a 4.2 percent decline in COMEX copper HGZ9 while London markets were shut on Monday for a holiday. On a monthly basis copper prices rose almost 7 percent in New York in August, making the market the second strongest after sugar in the 19-commodity Reuters-Jefferies CRB index. London copper saw a 13 percent rise last month and Shanghai futures gained 9 percent. US crude for October delivery CLc1 rose 33 cents to $70.29 a barrel. Spot gold XAU rose 0.4 percent to $954.45 an ounce from New York's notional close of $949.65.

(For more biz stories, please visit Industries)

|

|||||||