BizViews

Oil to hit $100 by end of year and keep rising

By Michael Economides (China Daily)

Updated: 2009-11-17 07:55

Oil has been flirting with $80 a barrel and from the start of this year, I have been predicting $100 oil before the end of the year, when almost all other analysts were predicted between $40 and $60. I am not quite ready to declare that I was exactly right and they were wrong but it looks like increasingly so.

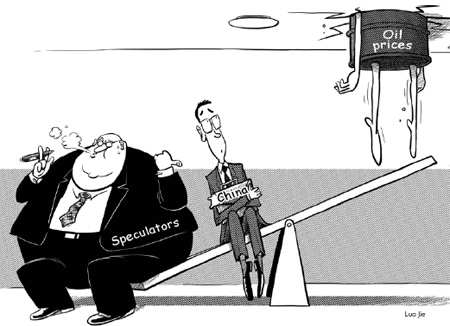

There are obvious and real underlying reasons for the escalating oil prices which we will expound upon below but news headlines have ruled the price of oil since at least 2004 and speculators can become unreasonably aggressive in riding the wave generated by the market. They exacerbate the situation.

There was no real rational economic reason for oil price to reach almost $150 a barrel (which for people with short memories may seem to have happened last century - it happened a year ago, in July) nor was there any reason for it to dip below $40, which happened right after late last year's "crises" - such as the economic crisis and the credit crunch crisis.

In fact, had it not been for those events delegating oil announcements to the 17th page of newspapers, a report by the International Energy Agency in Paris last November, which showed that world oil production from operating wells had been declining by 9.1 percent a year, the largest ever, would have shot oil price to over $200. Even now, there is a lingering possibility that a strike by Israel on Iran may close the Straits of Hormuz and shoot the price overnight to the stratosphere.

The headlines started in 2004 and included the Abu Ghraib photographs, which increased enormously the fear factor in the Middle East, the re-nationalization of oil industries in Russia and Venezuela. The perfect storm of headlines created one of the most telling and repeatable events from 2004 to last year's economic collapse. With escalating energy and energy product prices, every quarter ExxonMobil, the largest multinational oil company, would announce the biggest profit of any company in the history of the world and "Big Oil" would be in the mouth of many politicians in many countries as the devil-incarnate himself.

And yet that very same day, mystifying to many people, their stock would plunge because in smaller letters they would announce that their oil production and reserves were declining. Shut out of reserves in some of the most prolific oil provinces of the world, such as Russia and Venezuela, international "Big Oil" was, and is, in trouble.

Recent hints of economic recovery and the exchange rate of the US dollar are now being offered as the reason for the oil price rise. They are real reasons but they hide others. There should be no mistake: Oil-producing countries love $100 oil and they have little incentive to shoot themselves in the foot by increasing production. One of the main characteristics of oil-producing and -exporting countries is that despite enormous revenues many do not develop and diversify their economies, perennially depending on high oil revenues to sustain themselves.

Neither the price escalation of the previous four years nor the oncoming one have anything to do with "peak oil". This will eventually happen but not for decades. Physically but not necessarily politically, the world can produce 130 million barrels of oil a day, compared to the current 85 million. But proper investment, management and will are needed for that.

From 1998 when it produced 6 million barrels a day to 2005 when its production shot up to more than 9.5 million barrels a day (almost 10 percent increase a year), Russia was the brightest spot in the international oil business. There was talk of increasing production to 12 million barrels per day. Since then Russia has vegetated to about the same production and it looks like the country will enter a production decline.

Venezuela is an even bigger factor considering its oil dominance in the Western hemisphere. Before 1999 Venezuela was producing 3.4 million barrels a day and there were concrete plans to increase that production by now to 6 million. Instead, Venezuela is producing 2.6 million barrels a day, the lowest volume since the first nationalization in the 1970s.

Saudi Arabia is the only country with excess production capacity, estimated at 2.5 million barrels a day, and this is a role that the country found itself once more, in the 1980s, when at the prompting of then US president Ronald Reagan it over-produced. Russia and Saudi Arabia depend pretty much at the same level on oil and gas, and the two have the capability, if they choose, to bring enormous hardship on other oil-producing countries. There is no evidence they will do so, considering it will bring huge hardship on them as well.

Demand in developing countries, among which China dominates, will push the price upwards further. But questions about the impact of higher oil prices on the economic recovery itself are probably too alarmist. Certainly there will be some impact but as the economy expands the portion of it that is linked to oil is actually shrinking. This is something that we have called energy intensity that has been declining for the last 35 years. The bottom line is: The world economy can tolerate significantly larger oil prices than today.

All signs point that oil is on its way to $100 very soon and it will not stop there.

The author is Editor-in-Chief of the Energy Tribune.