Top Biz News

Rally in B shares wins new attention

By Zhang Ran (China Daily)

Updated: 2009-11-23 08:01

But after China permitted mainland companies to issue H shares in Hong Kong and launch IPOs in other global markets, B shares became an embarrassment in China's capital market due to their loss of their capital-raising ability and lackluster trading liquidity.

There are altogether 109 B-share companies listed on the B-share market, with a total market value of less than $30 billion - accounting for a mere 1 percent of the 1,600 A-share companies' market value.

From 1992 to 2000, 114 mainland companies issued B shares on the stock market. But after 2000, companies no longer listed initial public offerings. And since 2004, there has not been any form of fundraising activity on the market.

Ignoring the market

Several recent calls for B-share market reforms have fallen on deaf ears, and authorities have not been enthusiastic about such proposals in the past.

"For a long time, the foreign currency-denominated shares have been ignored as an investment class in China's stock market," Zhang said.

"Any moves that may hint at a new destination of B shares could easily drive them to soar, no matter if is to let B shares merge with the A- share market or in other ways to resolve B shares," he said.

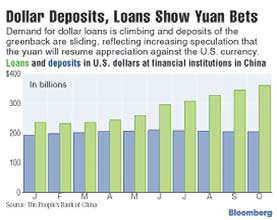

Meanwhile, the fact that the yuan is facing increasing pressure to rise is inviting more hot money inflows into the country, driving assets prices up, including B shares.

In September alone, Chinese financial institutions had to issue 406.8 billion yuan to buy foreign currencies, the highest in 2009, and much more than the amount used to buy foreign currencies from trade surplus and foreign direct investment inflows.

|

||||

"Because of the illiquid trading, any newcomer funds to the market could easily drive B shares to soar," Zhang said.

Skepticism

Many economists, however, maintain a skeptical view about the yuan's appreciation in the near term.

"Despite the central bank's apparent change in language, we do not think the renminbi will be allowed to appreciate very soon. We maintain our forecast of a stable renminbi for at least another six months before it reaches 6.4 to 6.5 at the end of 2010," said Wang Tao, head of China Economic Research with UBS Securities.

"We do not interpret this as a change in the renminbi exchange rate regime," said Goldman Sachs Gao Hua Securities in a recent report. "Top policy makers do not seem to have made up their minds to change the renminbi exchange rate."

Jia Wei, a Beijing-based stock investor with 10 years of stock investing experience, said he did not have a B-share account and will not consider buying B shares.

"I do not think the renminbi's value will rise in a short time, considering the economy is still fragile and relies too much on exports," Jia said.

"Psychologically, you must be very strong when investing in B shares," Liu Ye, a long-time investor who works as a website editor, told China Business Weekly.

"It is more volatile than the A-share market," Liu said.