Top Biz News

Strong demand lifts Shanghai copper

(China Daily/Agencies)

Updated: 2009-12-02 08:04

"It (the Dubai crisis) won't affect copper for too long either - we are already bouncing back towards $7,000. Investors seem positive towards copper for 2010 and I don't think there are a lot of people out there ready to sell on signs of strength." Barclays Capital analyst Yingxi Yu said.

Recent trading activity suggests the market views dips as an opportunity to buy in. On Friday, copper fell around $200 to $6,620 a ton on the London Metal Exchange, but had recovered by the close of trade to $6,855, up $34 on the day.

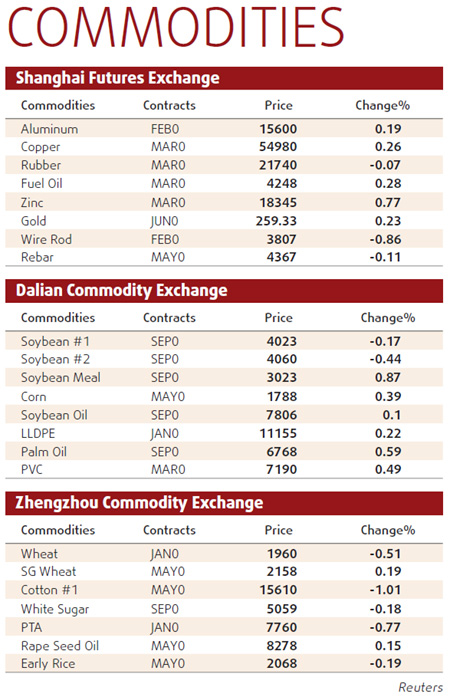

Three-month copper on the London Metal Exchange rose $30 to $6,960 in early trade. Benchmark third-month Shanghai copper closed 0.4 percent to 54,650 yuan yesterday.

Yu said she expected prices to trade within recent ranges for the rest of the year, with upside capped by the slow recovery in demand from OECD nations and expectations Chinese imports will continue to ease after a record first half.

At the same time, she felt there was little downside appetite given market optimism for demand next year in China.

"People expect pretty good growth... and China's manufacturing demand continues to be a positive for base metals," she said.

|

||||

It was the ninth straight month the official PMI has stood above 50, indicating an expansion of activity in the manufacturing sector.

"The PMI was supportive. But it will be difficult to break higher this month. Copper will trade between 53,000 and 55,000 for the rest of the year," a dealer in Shanghai said. "But we should see rising prices next year."

In other metals, nickel fell $25 to $16,375. The metal fell 10.4 percent last month, its biggest decline since February, but is still on course for a 40 percent annual rise.