Opinion

How market behavior will stir up instability

By Daryl Guppy (China Daily)

Updated: 2010-01-11 07:59

|

Large Medium Small |

It's the beginning of a new decade so it is useful to look back at market behavior. Human behavior does not change, but the mechanisms of the market change and this changes market behavior. It is one of the important challenges for market analysis because the analysis methods must always adjust to new conditions.

The first significant change is the way we participate in the market. Technology has made it easier for all market participants to collect the relevant market information quickly and at the same time. More importantly, technology has given all market participants the same analysis tools. The charting and technical analysis programs used by independent traders are very similar to the programs used by brokers and fund managers.

The second important change comes from how we analyze the information. Everybody has the same price and volume information. The same information is available to everybody at the same time. Previously there were significant advantages for people who received information first. Now these advantages are smaller because information is more easily available. The difference between success and failure depends on how we analyze the information.

The third important change is the increase in the speed of our ability to act on the information we receive. Ten years ago you might contact your broker by phone and then he would place the buy or sell order in the market using his computer system. Day trading, or intra-day trading was possible only for professionals.

Now traders can act on their decision very quickly. The buy or sell order is placed online and the trade can be completed in less than a second. This speed-of-order execution means emotional traders can act on emotions more quickly. The market moves more rapidly in response to breaking news events.

There has been an increase in day trading. Many ordinary people can now day trade but most people do not do this all the time. Many of the large funds are now moving to ultra fast 'flash' trading and this may add to price volatility.

The fourth important change is the commoditization of derivatives. At the beginning of the decade, derivatives were for specialists and they were constructed to meet specific over-the-counter company deal requirements. Now many derivatives are offered in standard contracts and traded by retail traders. In some stock exchanges, derivative-related trading in the equity market accounts for 40 percent of daily equity trading turnover.

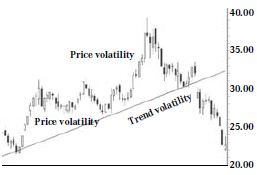

These changes have changed the nature of market behavior. They have increased the volatility of the market. This increases the trend volatility. This is seen where there are sudden changes in the direction of the trend. These changes have become increasingly common.

This also increases price volatility. In Western markets it is not unusual to see price movements of more than 10 percent in a day. This price volatility leads to large swings in price up and down within the trend. It leads to rapid rallies and retreats and this makes risk management more difficult.

| ||||

The market will continue to change. New technology will increase the volatility of price and make trend analysis more difficult. The challenge in the next decade is to develop analysis and trading methods that manage the increase in price volatility and trend instability.

The author is a well-known international financial technical analysis expert and is known as "The Chart Man".