Top Biz News

Debating the morals of vice mayor's stock trading

By Xin Zhiming (China Daily)

Updated: 2010-01-18 08:04

|

Large Medium Small |

Successful career

Zhong said there have been several similar cases but few have been indicted for insider trading. "Regulators have failed to do a good job," he said.

Analysts have argued that China should adopt the "inversion of evidential burden" rule in cases involving alleged insider trading, one that requires the accused to prove himself innocent.

In this way, it would make it harder for those engaged in insider trading to defend themselves, they said.

In Li's case, Zhong argued, he needs to show, for example, that he has made similar investments previously in the same stock using similar amounts of money to indicate that it was part of his regular investment behavior.

Were it not for the insider trading allegations, Li's career would have been as an example of success for many Chinese.

He majored in medical science in college and then graduated from Shanghai University of Finance and Economics. After that he became an accounts manager for a major joint-venture pharmaceutical company in Shanghai. Then he was admitted into the doctorate program of the Ministry of Finance's Research Institute of Fiscal Science before becoming an independent board member of the Guangzhou Baiyunshan Pharmaceutical Co Ltd of Guangdong province.

Later he became deputy general manager of the Guangzhou Automobile Group, one of the country's largest automakers. In early 2008, he was appointed deputy mayor of Shaoguan city in Guangdong province.

His career record as a successful businessman and high-ranking government official indicates that Li is capable of making investments in the stock market and be able to profit, according to some observers. Others say he should not dabble in stocks because he is a government official, although no laws or regulations forbid him from doing so.

"He's a (deputy) mayor and he shouldn't invest in stocks," said sales manager Yang. "If he really wanted to do that, he should first quit his job."

|

||||

Despite Yang's resentment of government officials investing in the stock market, China has no rules forbidding it. It used to ban government officials doing that, but that has now been relaxed.

Li told the media that the government actually encourages it, citing a rule issued in 2001 that said government officials can invest in stocks using their legitimate income.

However, the rule does state that insider trading is forbidden.

The rule also stipulates that if one assumes a new post that gives the person access to insider information, he or she should sell off the stocks involved within one month after he or she takes the new post.

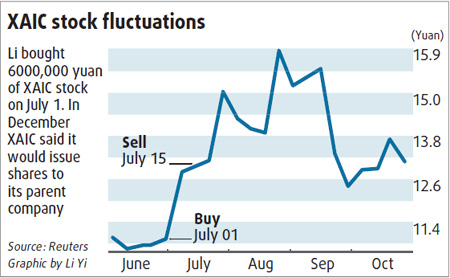

"I sold the XAIC stock on July 15 to steer clear of suspicion after I knew that it was very possible I would join its parent company," Li is on record as saying.