Daryl Guppy

The Greek crisis was no surprise

By Daryl Guppy (China Daily)

Updated: 2010-03-08 07:55

|

Large Medium Small |

The market does not like surprises. When surprises arise, market behavior is often exaggerated, with strong up moves on good news and powerful down moves when the news is bad. The developing situation in Europe triggered by the surprise revelation of debt problems in Greece has triggered instability in both European and American markets.

Greece will not leave the European Union and this puts pressure on the Euro, the cross currency rates and bond spreads. Friday's sale of Greek 10-year bonds at 6.3 percent looks surprising.

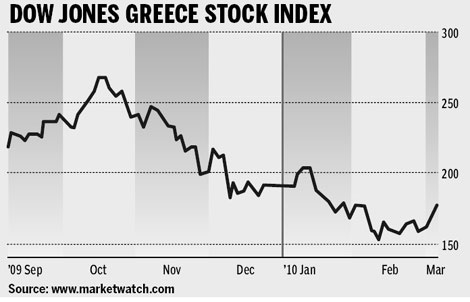

But is it really a surprise? Credit problems do not develop overnight. Credit problems of the size necessary to develop fear of a sovereign debt default do not suddenly emerge one Monday morning. The chart behavior of the Greek market index, the Athex 20, clearly shows the long-term development of this surprise debt revelation. Some European leaders are alleging fraudulent figures were included in the Greek economic reports and point to undisclosed currency swaps. The global reaction to the Greek situation is an interesting study in the behavior of markets.

The detail of the Greek collapse may be a surprise, but the collapse itself is neither stunning nor sudden. It's taken five months of steady decline to move the Greek market Index from the October 2009 peak of 1,565 to the recent value near 900. The current rebound above 1,000 that carries the index above the downtrend line is an early indication of favorable recovery so Friday's bond sale success is not a surprise.

This behavior raises some serious concerns about the way we do business as traders and investors. Fundamentally based analysis has an important role to play in understanding the market and individual companies but investors have assumed it offers a level of safety. An audit, or a government report, is not a safety shield.

Some company accounts were manipulated or "cooked" from the time double entry accounting gained wide acceptance in the commercial world of the Renaissance.

Unquestioning investor trust and naivety is always an invitation to hustlers and sharks. Increased regulation, improved reporting standards and other reforms only make the task of fraud more challenging. It does not make it disappear. So what can you do to protect yourself?

There are two sets of important figures available in the market. One set is a guess estimate and is only as reliable as the truthfulness of the original reports. These figures include Greek economic reports, the quarterly statements from Bernie Madoffs' investment fund and the annual reports from Bear Stearns and other corporations. I treat them with suspicion and always try to verify them by using entirely different and independent methods.

The second set of figures is objective and verifiable. They consist of the open, high, low, close and volume figures for each stock or index as it is traded each day. You cannot fiddle these figures. They cannot be massaged. They are independently verifiable. Everyone has access to them. Their values are not dependent upon your status as an investor, a tax officer, an auditor or an institutional trader.

These figures provide a most significant way to independently verify what others are saying. They help restore trust in a battered financial system. Their application does not have to be complex. In Greece it starts with simple observations of the daily chart of the Athex 20 index.

Start with the high in October 2009 near 1,565. Several features suggest the index might go down. First is the clear move below the uptrend line in October 2009. It is a warning sign because this did not happen in other European markets.

The author is a well-known financial technical analyst.

(China Daily 03/08/2010 page14)