World Business

Airline tie-up may reshape industry in US

By Mary Jane Credeur (China Daily)

Updated: 2010-04-09 09:28

|

Large Medium Small |

ATLANTA, Georgia - UAL Corp's United Airlines and US Airways Group Inc, both of which filed for bankruptcy last decade, are holding talks on a merger that would reshape the US industry, sources said.

Discussions began in mid-February on the tie-up, which would help United steer travelers to international flights from US Airways' domestic routes, said one of the sources, who asked not to be identified because the negotiations are private. Spokespersons for the companies declined to comment.

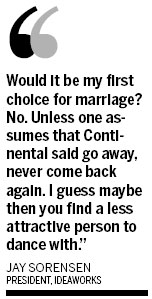

Combining United and US Airways would create the second-largest US carrier and put pressure on AMR Corp's American Airlines, now No 2, and Continental Airlines Inc, which held merger talks with UAL in 2008. Wider route networks boost revenue by allowing airlines to funnel in more passengers. British Airways Plc, Europe's No 3 carrier, and Spain's Iberia Lineas Aereas de Espana SA said on Thursday they signed a definitive agreement to a $7.5 billion merger.

"United and US Air are already in the Star Alliance, so that's a hurdle that's already been cleared," said Hunter Keay, an analyst at Stifel Nicolaus & Co in Baltimore. "Both of their top executives are the biggest proponents of consolidation in the industry. And they tried twice before to merge."

Terms of a proposed merger haven't been presented to the airlines' unions, nor have the companies' boards been asked to vote on a deal, one of the people said.

UAL ranks third in the US by traffic and market value, at $3.17 billion, based on data compiled by Bloomberg. US Airways is No 6 by traffic and No 8 by market value, at $1.1 billion. Delta Air Lines Inc is the world's biggest airline by traffic and leads domestic carriers in market value, at $11.1 billion.

UAL climbed $1.50, or 7.9 percent, to $20.45 late on Wednesday on the Nasdaq Stock Market. Tempe, Arizona-based US Airways jumped $1.41, or 21 percent, to $8.23. Keay, the analyst, recommends buying Chicago-based UAL and doesn't rate US Airways.

"We don't comment on rumors or speculation," said Jean Medina, a spokeswoman for United. "We've been consistent on our position on consolidation generally for several years, and that position is well known."

James Olson, a US Airways spokesman, also declined to comment.

The new United-US Airways talks revive an effort that collapsed in 2008, less than two months after Delta Air Lines Inc agreed to acquire Northwest Airlines Corp and spurred merger discussions across the industry. A bid by United to buy US Airways was scuttled in 2001 when US regulators objected.

|

||||

United Chief Executive Officer Glenn Tilton has championed mergers since before the carrier left more than three years in bankruptcy protection in February 2006. In 2005, US Airways CEO Doug Parker led a merger with America West Holdings Corp after a bankruptcy and made a hostile bid for Delta in 2006.

Tilton said in a Jan 21 interview that global alliances are smoothing the path to mergers because they forge closer ties among carriers. He predicted a merger involving US airlines would happen in the next 12 to 24 months.

News of the talks came as a surprise, said James Ray, a spokesman for the US Airline Pilots Association, the union representing US Airways pilots. David Kelly, a spokesman for the United chapter of the Air Lines Pilots Association, didn't return messages seeking a comment.

US Airways has some pilots working under a labor contract that includes change-of-control provisions that would boost expenses in a merger, so one option might be to make US Airways the acquiring company, said Robert W. Mann, owner of consultant R.W. Mann & Co in Port Washington, New York.

"There are some real cost-oriented poison pills that, if they were triggered, would make it very unattractive," Mann said.

Bloomberg News