Money

Goldman probe may boost China, India bank stocks

By Jonathan Burgos (China Daily)

Updated: 2010-04-22 10:10

|

Large Medium Small |

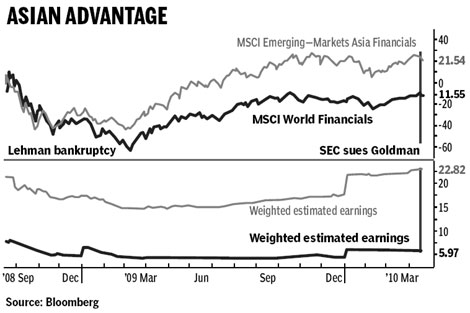

SINGAPORE - Bank shares in countries such as China and India, which have outperformed global rivals by about 30 percentage points since the "Lehman shock", may extend their advantage amid fraud probes of Goldman Sachs Group Inc.

The Chart of the Day shows MSCI Morgan Stanley Capital International's (MSCI's) financials indexes for emerging-markets in Asia and worldwide starting from Sept 15, 2008, when Lehman Brothers Holdings Inc filed for bankruptcy. The bottom panel compares the gauges' weighted estimated earnings, based on data compiled by Bloomberg.

Goldman was sued by the US Securities and Exchange Commission (SEC) on April 16. Asia's emerging markets as defined by Morgan Stanley for its indexes include China, India, South Korea, Malaysia, Thailand, Indonesia, Philippines, Cambodia, Pakistan and Vietnam.

| ||||

The financial crisis in 1997 caused Asian banks to be "more prudent", allowing them to strengthen balance sheets, said Do. That crisis, triggered by plunging currencies, forced Indonesia, Thailand and South Korea to seek International Monetary Fund aid. Asia's emerging-market countries have about $3.7 trillion in reserves, almost half the global total.

"Asian banks in general have more healthy balance sheets, and their loan growth so far has been recovering quite well versus still-negative loan growth in the United States and European banks," said Grace Tam, Hong Kong-based vice-president of investment services at JPMorgan Asset Management Ltd, which manages about $102 billion in Asia-Pacific assets.

The SEC suit against Goldman linked to collateralized debt obligations may also trigger stricter scrutiny from European regulators. The UK Financial Services Authority said it will investigate Goldman Sachs International.

The European Union is also probing the bank's role in arranging credit swaps for Greece that may have masked the country's budget deficit.

BLOOMBERG NEWS