Home appliance producers benefit from strong rural sales

By Joy Li (HK Edition) Updated: 2011-02-15 06:53

Robust sales of home appliances across the nation's rural areas sent manufacturers' share prices higher Monday. Meanwhile, analysts believe that "white goods" such as air conditioners and refrigerators will edge out "black goods" such as television sets due to the former being a less saturated market.

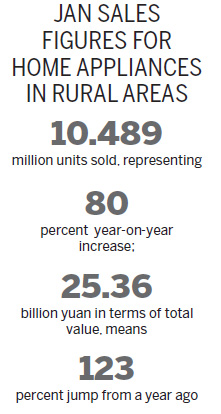

According to the Ministry of Commerce, sales of home appliances to rural areas in January 2011 reached 10.489 million units with a total value of 25.36 billion yuan, up 80 percent and 123 percent, respectively, from a year ago. It was the first time that the single-month sales volume broke the 10 million units level, the ministry said in a statement released Monday.

Sales of color TV sets and refrigerators were ranked first and second nationwide, with a value of 9.09 billion yuan and 5.77 billion yuan respectively, a share of 59 percent of total sales, according to official figures.

The market responded positively to the strong figures, with shares of home appliance manufacturers listed in Hong Kong up sharply.

Haier Electronics, a unit of Qingdao-based Haier Group - which is the world's biggest refrigerator and washing machine maker by volume - rose 8.28 percent to HK$8.23. Chigo Holdings, one of the largest air conditioners makers on the mainland, gained 10.53 percent to HK$0.63. Skyworth Digital, a major television maker, rose 5.24 percent to HK$4.82. All significantly outperformed the benchmark Hang Seng Index which closed up 1.28 percent at 23121 points on Monday.

Zhang Zejing, an analyst with mainland-based Hongyuan Securities, cited several factors that had stoked the sales surge in a report released on Monday. According to Zhang, income growth in rural areas, as well as an improved social security system that leaves people with more money to spend, served as fundamental drivers. Meanwhile, seasonal factors such as the Spring Festival, which traditionally brings about a shopping binge, also helped boost the final figures for the month.

However, the home appliances sector could prove to be a tale of contrasting fortunes.

"I see a brighter future in the 'white goods' league than 'black goods', said Miles Xie, an analyst with BOCOM International, a security house under the Bank of Communications group.

Xie thinks that the growth momentum of colored TV sets will slow down in 2011 after a year-on-year surge of 45 percent, or an annual sales volume of 35 million units, in 2010. A gradually saturated market may entail a price war, weighing on makers' profit margins, Xie told China Daily.

On the "white goods" side, the outlook is rosier since the competition is less cut-throat and the makers maintain control over the supply chain, whereas colored TV sets manufacturers rely on imports for certain upstream parts, according to Xie.

Take air conditioners for example. Norman Zhang, an analyst with Kim Eng Securities, wrote in a December research report that "the relatively low penetration rate of air conditioners in the rural areas (9.8 percent in 2008), coupled with the wave of property development in rapidly urbanizing areas, augurs well for the product's long-term growth momentum."

Zhang from Hongyuan Securities also thinks that "white goods" makers are a good buy for investors, particularly those with strong sales networks in rural areas, such as Haier Electronics. Big brand names in the "white goods" camp enjoy a stable earnings outlook and are currently undervalued, according to Zhang.

China Daily

(HK Edition 02/15/2011 page3)

- New driving force bringing momentum to economy: Premier

- China mulls allowing more to practice asset appraisal

- Sharing economy is also mass innovative economy: Li

- Evernote aims to grow China into world's largest market in three years

- ROK becomes Yantai's biggest foreign trade partner

- Xiaomi to go public in nine years: Lei Jun

- Vanke's shares plunge in HK on reported move to oust chairman

- Buy or hail?