|

|

Editor's note: Small and medium-sized enterprises (SMEs) tend to suffer more cash-flow problems and human resources shortages than big businesses with bigger budgets. The government is trying to help SMEs by issuing preferential policies and helping them obtain more funds from banks. |

|

SMEs need to have more than courage To date, China has over 50 million small- and medium-sized enterprises (SMEs), which account for 80 percent of the country's jobs, 60 percent of gross domestic product (GDP) and half of the national tax revenue, according to the Ministry of Commerce. One of the important factors for businesses' survival is the availability of a healthy cash flow. Yet for SMEs, maintaining a positive cash flow is often far from their reach. Despite government measures to assist SMEs, the amount of funding and further tax reductions continue to nag officials. [Full Story]

More Stories Growth of SME loans outpaces credit to large firms SMEs see higher industrial output growth

Small- and medium-size enterprises (SMEs) in Wenzhou are faced with severe cash-flow problems as they find it hard to access bank loans or personal loans due to tight lending policies. "A recent survey found that over 70 percent of 1,000 enterprises in our association have severe financial problems and only a few managed to get enough money to finish orders," said Zhou Dewen, the head of the Wenzhou Small- and Medium-sized Enterprises Promotion Association. Zhou said many enterprises are borrowing money from all available sources to keep their businesses running and to fulfill orders from their clients. Many SMEs are borrowing money from the gray market private money lenders for short-term financial needs.[Full Story]

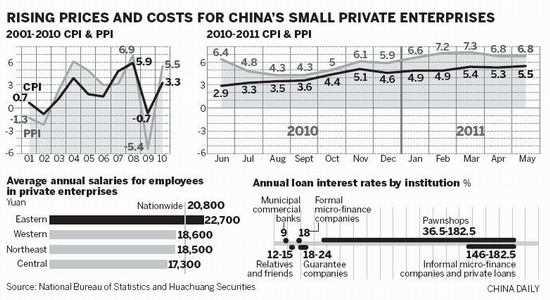

Small firms, big problems as costs rise The rapid rise in labor costs and the soaring price of raw materials, together with the increasing cost of borrowing, has left small and medium-sized businesses (SMEs) there facing a dilemma. In June, inflation in China showed no signs of abating. The consumer price index, the main gauge of inflation, rose to 5.5 percent in May, and when the figures for June are released in the middle of next month, they're expected to confirm another increase. Moreover, the Producer Price Index, which reflects changes in the prices of raw materials and other costs, came in at 6.8 percent in May, down from 7.3 percent in March, but still much higher than in September, when it was 4.3 percent. Meanwhile, the authorities have cracked down on lending and the money supply to combat inflation, a move that has further increased the pressure on China's capital-thirsty small businesses. To make ends meet, some businesses have even been forced to use underground financing sources, which charge exorbitant interest rates. Moreover, wages have been rising continually in recent years, adding to corporate costs. [Full Story] More Stories: Soaring CPI puts squeeze on manufacturers Small manufacturers shudder at rising costs Improved access to loans not a cure-all for small firms Labor secretary warns of strict enforcement for wage law

China adds micro-business category China's top economic regulators subdivided categories of small- and medium-sized enterprises (SMEs) by adding a "micro-sized enterprises" category, the Oriental Morning Post reported on Tuesday. The new category standard was released on July 4, by the National Development and Reform Commission, National Bureau of Statistics, Ministry of Finance, and Ministry of Industry and Information (MIIT). The standards are designed to help SMEs with preferential policies. Zhu Hongren, a chief engineer at MIIT, said creating new categories for small, medium-sized and micro-sized enterprises will make it easier for the government to collect data and also help SMEs to provide more jobs.[Full Story]

|

|

China to further open up its financial market: PBOC China will further expand, optimize and open up its financial market, and gradually reduce central government market interventions in 2011, the People's Bank of China (PBOC) said in a report April 8, 2011. It will also further open up the domestic bond and stock markets in the year to foreign investors and let more currencies be traded against the yuan, said the report. The government will play an active role in guiding and supporting key industries, especially small and medium-sized enterprises, to diversify financing mechanisms through issuing multiple bonds and developing other new financing channels, said the report. [Full Story]

|

|

Green SMEs may get financial boost An arm of a leading global think tank on environment is considering setting up a special fund to aid China's small- and medium-sized enterprises (SME) in the environment sector. "We plan to investigate the feasibility of running such a fund in China in the next two years," said Zhang Tao, chief operating officer of New Ventures, a program at Washington-based World Resources Institute. "It is very difficult for those environmental SMEs to get investment for further development," said Zhang whose agency has been offering strategic support to environmentally focused entrepreneurs in emerging economies since 1999.[Full Story]

|

|

Alibaba broadens SME loans Alibaba Group, the Chinese e-commerce giant, will expand its small-loans business with two of the largest Chinese commercial banks in March and persuade 15 lenders to join this year. Li Feng, director of the loan division at Alibaba Financial Co, told China Daily that the company's cooperation with China Construction Bank (CCB) and the Industrial and Commercial Bank of China (ICBC) had been successful and will continue to expand. [Full Story]

Bank to offer more fund to to SMEs While small and medium-sized enterprises (SMEs) are experiencing difficulty borrowing money from commercial banks, China Merchants Bank Co Ltd is cooperating with private-equity (PE) companies to help alleviate the problem. Ma Weihua, president and CEO of China Merchants , said on Friday that the bank is planning to choose 1,000 SMEs in the high-technology sector from its client lists and to recommend them to PE firms. [Full Story]

More stories: |

|

Improved access to loans not a cure-all for small firms New government measures that will create more financing opportunities for China's small businesses will provide aid in the short-term, but will not be a complete cure for the problems these companies face, according to some of the country's financial experts. [Full Story] Due diligence is vital in distressed transactions Hong Kong manufacturing SMEs have recently faced numerous challenges. They have encountered cost issues due to yuan appreciation, wage increases, and rising raw material and utility costs. [Full Story] SMEs need right tools to rein in costs Small- and medium-sized enterprises (SMEs) in China must upgrade their technologies and transform themselves to cope with intense competition and rising labor and raw material costs. What's more, the rising yuan has also compounded problems for SMEs. The yuan rose to a new high of 6.4696 against the US dollar on June 20, a 5.24 percent growth from a year earlier. Prior to June 19 last year the US dollar was valued at around 6.8275 yuan. The significant yuan appreciation has now added to the cost worries for exporters. [Full Story] Spare a thought for SMEs The People's Bank of China has raised the reserve ratio twice and interest rates once this year. This indicates that macro-policies will be tightened to control liquidity because of inflationary fears. But such policies should take into consideration the condition of small- and medium-sized enterprises (SMEs), too, says an article in Jiefang Daily. [Full Story]

|

|

|