Hurun shows property is still key to riches

Updated: 2011-09-23 09:20

By Gao Yuan (China Daily)

|

|||||||||||

129 $ billionaires listed in China; expert says there are many more

BEIJING - The real estate industry is the biggest source of wealth for the richest people in China, the country with the largest number of US dollar billionaires, said Rupert Hoogewerf, chairman and chief researcher of Hurun Research Institute.

About 23.5 percent of the 1,000 richest Chinese individuals' fortunes comes from the property industry, up from last year's 20.1 percent, according to the Hurun Rich List 2011, which focuses on people in the real estate industry, released on Sept 22.

Despite the property market weakening in the past months, because of government measures to tame soaring real estate prices, Hoogewerf said he still believes that China's real estate business is a solid investment.

"The real estate industry in China will be the world's safest field to invest in the coming 15 years," he said.

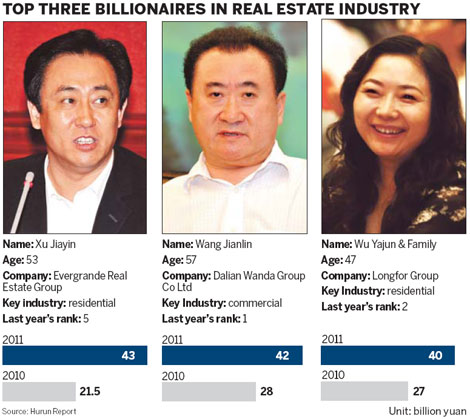

Xu Jiayin, chairman of Guangdong-based Evergrande Real Estate Group, was the richest developer, according to Hurun, with 43 billion yuan ($6.74 billion). Xu's fortune was 21.5 billion yuan in 2010, according to the report. Evergrande's core business is residential properties.

Dalian Wanda Group Co Ltd's chairman and last year's richest developer on the Hurun list, Wang Jianlin was ranked No 2, with 1 billion yuan less than Xu. Wang's fortune jumped 14 billion yuan since 2010. Last year's runner-up, Wu Yajun and her family who control Longfor Group, dropped to the third place. But her family's wealth also increased 13 billion yuan over the past year.

As one of the latest moves to cool the overheating property industry, the central government ordered provincial-level governments to report the progress in curbing property prices in mid-August. Forty-four cities saw the prices for new homes decline or remain unchanged in August month-on-month, the National Bureau of Statistics said.

The prices for new homes in 10 first-tier cities, including Beijing and Shanghai, have declined 0.41 percent in August month-on-month, reaching 15,773 yuan a square meter, the China Index Academy said on Sept 13, adding that this is the first decline since September 2010.

The new round of home-purchasing restrictions targeting second- and third-tier cities could help to dampen home prices in first-tier cities such as Beijing and Shanghai.

However, some analysts believe that China's property prices - especially in first-tier cities - could remain strong because of the nation's urbanization process.

"The urbanization process could create a huge amount of wealth ... and the real estate industry is the hothouse of the entire commerce," said Jin Yanshi, former chief economist of Guojin Securities. The gross value of China's real estate industry is more than 5 trillion yuan, while the value of the stock market is only about 2.5 trillion yuan, Jin said.

In addition, Chinese developers are shifting their businesses from residential projects to commercial and industrial property projects, which could inject vitality into the industry, said Wang Zhongming, assistant secretary-general of the All-China Federation of Industry & Commerce.

Meanwhile, according to Hoogewerf, although there are only 129 US dollar billionaires on the list, the number of dollar billionaires in China could hit 600, making it the nation with the most dollar billionaires, surpassing the United States. The US now has about 400 billionaires, he said.

"The major reason (that about 400 billionaires were excluded from the list) is that some entrepreneurs' companies are not listed, which makes it hard to estimate their wealth," he said.

The fastest-growing sources of wealth are the information technology, retail, commodities, and healthcare industries, Hoogewerf said.

Google Inc's withdrawal from the Chinese market last year allowed Robin Li's Baidu Inc to establish its leadership in the Internet search engine business. As the CEO and co-founder of the company, Li was named the richest man in China's IT industry, with a fortune of 56 billion yuan. Tencent Inc's Chairman Pony Ma ranked No 2 with 34 billion yuan.

Related Stories

Property market cooling 2011-09-19 09:34

Property firm calls for lower fees for infrastructures use 2011-09-16 15:30

Property prices will fall in next 12 months, HK developer Lo predicts 2011-09-14 10:53

China to stick to controlling property market 2011-08-26 09:17

- AstraZeneca relies on partners

- Hurun shows property is still key to riches

- China IPOs to hit record in Germany

- Trade with Arab states sets record

- Car Free Day fails to get traffic off roads

- Liquidity remains tight despite cash injection

- China's manufacturing continues to contract in Sept

- Billionaires shy away from rich list