Economic slowdown won't mean easing

Updated: 2011-10-19 09:06

By Li Xiang (China Daily)

|

|||||||||||

GDP grows less than forecast in Q3, analysts still anticipate soft landing

BEIJING - Although the Chinese economy is expanding at the slowest pace in two years, it's unclear if policymakers will ease their grip on credit to push the rate of growth back up, analysts said on Tuesday.

GDP expanded 9.1 percent year-on-year in the third quarter, less than the 9.3 percent that many economists had forecast and also below the second quarter's 9.5 percent growth rate.

Analysts said that further tightening measures would be unnecessary, given the unexpectedly slow pace of growth. At the same time, they said, consistently high inflation made a shift in monetary policy unlikely.

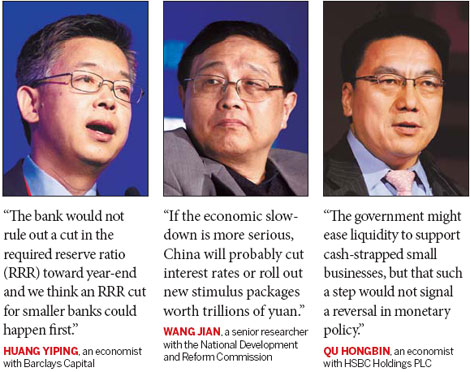

Qu Hongbin, an economist with HSBC Holdings PLC, said that the government might ease liquidity to support cash-strapped small businesses, but that such a step would not signal a reversal in monetary policy.

Although the consumer price index (CPI), a main gauge of inflation, edged down to 6.1 percent in September from 6.2 percent in August, the figure was still above 6 percent. The month-on-month rate has yet to decline.

Some economists warned that if the economy cooled too quickly, Beijing might be prompted to adopt an easier stance to avoid an economic hard landing.

Wang Jian, a senior researcher with the National Development and Reform Commission, the top economic planner, said that any relaxation would start with larger loan quotas for small companies.

"If the economic slowdown is more serious, China will probably cut interest rates or roll out new stimulus packages worth trillions of yuan," he was quoted by the China Securities Journal as saying.

The central government has vowed to cut taxes and extend greater financial support to small businesses. The pledges followed Premier Wen Jiabao's visit to Wenzhou, Zhejiang province, amid concerns about surging bankruptcies among private enterprises that can't repay debt to underground lenders.

"Since liquidity problems have just started surfacing and the property sector has begun correcting, we expect more bumpiness ahead," said Yao Wei, an economist at French bank Societe Generale AG.

"The central government is likely to roll out more policy easing from week to week. This slowdown will be less dramatic than that in 2008, and the easing will probably be gradual as well," she said.

Economists at Barclays Capital, the investment banking division of Barclays PLC, said in a research note that a broader-based easing would depend on export growth and labor market conditions.

The bank would not rule out a cut in the required reserve ratio (RRR) toward year-end and "we think an RRR cut for smaller banks could happen first", wrote Chang Jian and Huang Yiping.

Despite the weaker-than-expected GDP growth, retail sales rose 17.7 percent year-on-year in September, beating market expectations.

Industrial output also recorded higher-than-expected growth of 13.8 percent.

Economists said that China was unlikely to see a sharp fall in economic growth and resilient domestic demand would support a soft landing.

Related Stories

China's Q3 GDP grows at slowest pace in 2 yrs 2011-10-18 10:21

'9% GDP growth' for 2011 2011-09-29 10:39

China's GDP expected to grow 9% in 2011 2011-09-28 17:32

Slower GDP growth in Q4 predicted 2011-09-26 13:57

- Aigo prevails in lawsuit filed against Toshiba

- China warns of 'grim situation' in foreign trade

- Corruption still rife in construction industry

- Scandals put a big dent in donations

- China's FDI rises 16.6% in Jan-Sept

- Angry Birds to land in Shanghai

- Rare earths to become even rarer

- LeTV, Tudou to set up JV