'Tough love' policies cool passion for property

Updated: 2011-12-21 09:30

By Wang Ying (China Daily)

|

|||||||||||

|

A real estate agent tries to interest a driver in a villa in Shanghai on Nov 5. Cash-strapped developers and real estate agents are desperate to seek buyers amid a sluggish market stemming from the government's tightening policies. [Photo/China Daily] |

|

Housing sales information is posted in unlikely-seeming places - here, on a pedestrian overpass in Beijing - but sales agents want it to be noticed. Transaction volumes slumped this fall. [Photo/China Daily] |

Developers and agents forced to resort to extreme measures as prices fall and transactions slump, Wang Ying reports from Shanghai.

China's "tough love" monetary policies, to cool the ardor of the property market, are dampening the passion of buyers. The volume of transactions slumped markedly in September and October, traditionally the peak season, and sellers are resorting to novel ideas to unload their property.

"Buy a villa, get a plane for free." That pitch, reported by Shanghai's eastday.com, was made for a villa in the Minhang district of Shanghai.

The listing price: 65 million yuan ($10.2 million).

The plane, modeled after a World War II-era fighter, has neither an engine nor a fuel tank and it lies in the villa's backyard.

The agent said the property comes with a private tennis court and a 4,300-square-meter garden.

The owner bought the property in 2000 as an investment but has never actually lived there, the agent said.

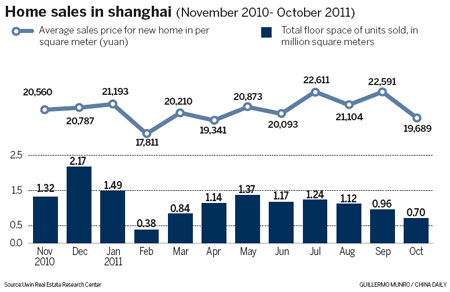

Experts say that case provides new evidence that the housing market has reached a turning point. According to Uwin Real Estate Research Center, 695,900 square meters of new housing were traded in October in Shanghai, a one-month drop of 27.56 percent and a one-year drop of more than 50 percent. The average sales price also weakened, by 1.65 percent in a year, to 19,689 yuan a square meter.

Sales of used homes hit their lowest point in five Octobers: 8,100 units changed hands, down 21.4 percent in a month and 40.2 percent from a year earlier, according to Century 21 China Real Estate's Shanghai Research.

Analysts said those figures bode ill for the year-end, when sales are typically slow. And sales gimmicks aren't as effective as price reductions.

"To be honest, using the fighter jet or a high-end sedan as a gift is not the best choice, because such a gift is not what homebuyers really want, and it will increase the total cost of owning the property" because of maintenance, said Song Huiyong, a research director with Shanghai Centaline Property Consultants.

Joe Zhou, local research director for Jones Lang LaSalle real estate consultancy, said, "At the moment, quality and price are the deciding factors. And only by offering a reasonable price and an attractive discount can property projects receive better sales."

Big sale, big reaction

Figures from China Real Estate Info Corp show that four property projects in Shanghai raked in 101 billion yuan after offering sizable discounts. Earlier buyers who had paid higher prices stormed their sales offices, demanding refunds from the developers - unintentionally helping to market these on-sale properties.

"It's just so obvious that those people feel it's unfair because they had paid more than other buyers," Lin Jianjun, 40, said as he checked out one of the big sale projects, hoping to buy one in Songjiang district. "After all, they were just hoping to get some compensation from the developer."

Chen Weiming, 27, said the heated scenes reminded him of late 2004 and 2005, when drawings were held to determine who could get a purchase contract for a home. Chen, who had lined up with others wanting to buy an apartment, said, "Almost all the buyers in the queue agreed that the price was really attractive. The property sales office is more like a popular pavilion during the Shanghai World Expo."

The fury of earlier homebuyers and the eagerness of those seeking a good bargain reflect the significance of a home in China, experts said. A rise or decline in the housing price can whip up Chinese people's sentiment.

"I have earned myself 50,000 yuan this week," property agent Wang Chenyun said. "I just bought a new home in Huangpu district for my parents and a new car for myself."

Wang said that lately, he has been selling two apartments a week, and each sale earns him about 6,500 yuan in commission.

Little choice

Senior sales agent Lu Changhong, 32, said bigger discounts and more advertising gimmicks will be churned out because "property developers have to" use them.

"They have to pay bank loans, pay salary to construction workers, and bid for land when the land price is discounted at year-end," Lu said. "As a result, property developers will continue the big sales. In my eyes, it is a win-win choice for both the developers and most buyers."

A survey conducted by Sina.com's home channel shows that as of June 30, more than one-third of the nation's 189 listed property developers had a debt-to-assets ratio above 70 percent. Separate data from Wind Information Co Ltd show that at the same time, those developers' combined debt totaled 1.24 trillion yuan.

"Capital conditions are the top secret of a company, but by noticing the projects giving the most extended discount, we can tell which company is short in capital flow," said Huang Zhijian, Uwin's executive director in Shanghai. "As to lowering project prices, it is the least thing a property developer will do." Huang said a big price cut for every single project is impossible, "but a majority of the projects will follow the trend".

Considering the central government's steadfast approach to cooling home prices, more major property developers will promote sales through diverse measures over the next three months, said Chen Sheng, deputy director of the China Index Academy in Shanghai. They need to keep their heads above water.

Shen Chen in Shanghai contributed. Write to the reporter at wang_ying@chinadaily.com.cn.

Related Stories

Property price growth slows 2008-10-23 09:54

Government to boost property market 2008-10-17 16:05

Policy impacts on property sector 2006-08-10 08:52

- Prudent monetary policy to continue: PBOC

- China to step up local pension fund management

- Ping An to issue $4.1b convertible bonds

- Real-name system to curb train-ticket scalping

- 'Tough love' policies cool passion for property

- Oil spill response base network set to open

- Li calls for green drive to improve economy

- Foreigners flock to China for job opportunities