Job market is not working for some

By Ding Qingfen and Chen Jia in Beijing and Yu Ran in Wenzhou (China Daily) Updated: 2012-07-26 10:39Signs of economic stress are increasingly apparent, Ding Qingfen and Chen Jia in Beijing and Yu Ran in Wenzhou report.

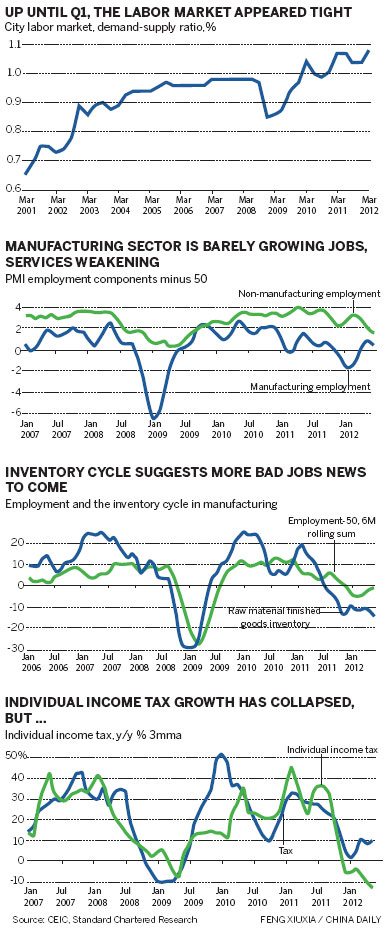

The job market has started to show signs of stress, and while the situation is nowhere near as bad as in 2008, life is getting harder for employers and employees alike.

|

|

|

Job seekers look for opportunities at an employment market in Lianyungang, Jiangsu province on July 21, 2012. China's job market has been showing signs of stress. [Photo/China Daily] |

Pugongzhong road in Wenzhou city, Zhejiang province, provides a perfect example of the problem. It was once home to more than 40 manufacturers and exporters, but now only around 10 are left and many are struggling to keep their heads above water.

Wenzhou Jinlishi Shoes Co, and its 300 workforce, is one of them. In the company's No 1 workshop, covering an area of 500 square meters, fewer than 40 workers man the production line and the atmosphere is far from hectic.

"It's hard to do business. Orders have been declining since last year. And what's worse, costs continue to increase, with both wages and raw materials surging by 20 percent," said Ke Zhongliang, the sales manager.

"We have no choice but to cut jobs," he said.

So far this year, the company has terminated the contracts of 100 employees and closed one of its three production lines.

The parlous state at Jinlishi is one of the indicators that suggest an increasing number of workers are being laid off. Moreover, economic conditions mean it's getting tougher to find employment. Economic growth has decelerated to the slowest pace in three years as a result of the European debt crisis and the government's crackdown on property speculation.

In the heavy industry sector, some of China's largest companies have laid off workers or implemented hiring freezes in the past few months. Media reports claim that Sany Group, the country's biggest manufacturer of construction equipment by revenue, has downsized its workforce in the manufacturing, sales and research divisions. The company denied the reports, insisting that it is simply controlling the growth of its 51,000-strong workforce.

In the construction sector, a large number of migrant workers are finding it hard to extend their contracts and many plan to return home.

"The three big sectors that are currently dragging on the economy - infrastructure, real estate and exports - are big employers," according to a report by Stephen Green, chief China economist at Standard Chartered Bank.

The National Bureau of Statistics said recently that China's gross domestic product slowed to 7.6 percent in the second quarter from a year earlier, the sixth straight quarterly slowdown.

Meanwhile, economists and officials have warned that the world's second-biggest economy has yet to hit bottom, predicting that expansion may further cool to 7.4 percent in the third quarter, citing weak overseas demand.

Overseas shipments in the first half gained by 9.2 percent year-on-year and imports surged by 6.7 percent, said the General Administration of Customs. The Ministry of Commerce said the outlook is gloomy, and warned that it will not be easy to maintain growth of 10 percent in foreign trade across the entire year.

- Urban push to propel next reforms

- Emirates Airline spreads its wings in China

- Mexican curbs 'singe' Chinese steel firms

- Widely-used smart products to drive big data usage

- Uber gets new ally to take on fresh challenges

- Top 10 energy efficient cities in China

- China eyes supply-side reform for new growth

- Local gov't debt risk under control this year: report