HK consumer confidence dips in Q3

(China Daily) Updated: 2012-11-19 09:47Consumer confidence in the city in the third quarter dropped significantly as gloomy global economic outlook has further dampened Hong Kong's perspective and raised recessionary concerns numbing confidence towards more spending, according to global business information provider Nielsen.

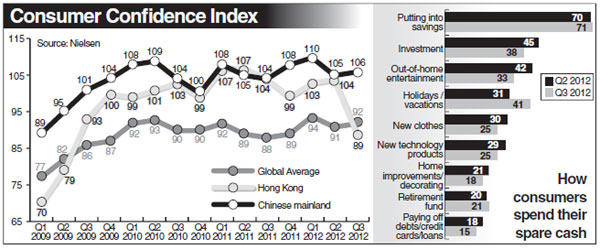

According to the report, the consumer confidence in the third quarter fell 15 points to 89 from 104 points in the second quarter, representing the lowest level since the second quarter of 2009.

|

Pedestrians walk past stores on Russell Street in Causeway Bay. Hong Kong's consumer confidence slumped in Q3 as the global economic outlook further dimmed. [Photo/Agencies] |

The consumer confidence decline has been impacted by the increasingly negative outlook for job prospects, personal finances and spending intentions in the immediate future.

In the third quarter, 35 percent of Hong Kong residents said they were optimistic about job prospects for the next 12 months, down from 50 percent in the second quarter. Optimism for personal finances also fell from 61 percent in the second quarter to 43 percent in the last quarter, in turn affectingconsumers' immediate spending intentions, which fell from 51 percent to 31 percent in the same period.

"Europe's ongoing debt crisis, the fluctuating US recovery data and the speculation of the mainland's economic growth in the last quarter has resulted in increased concern of Hong Kong's own economy, with more consumers believing we are in recession," said Nielsen Hong Kong Managing Director Oliver Rust.

In the third quarter of 2012, 60 percent of Hong Kong consumers said they felt the city was in recession, up 19 percentage points from the previous quarter.

"The data demonstrates how sensitive Hong Kong consumers reacted to regional and global economic conditions of our trading partners," Rust added.

"During uncertainty periods, cautious Hong Kong residents always rein in discretionary spending and what we have seen in the last quarter is no different (from past experiences) as consumers pulled back on nearly every aspect of discretionary spending," observed Rust.

|

|

According to Nielsen, only savings and retirement funds enjoyed marginal increases of one percentage point from the previous quarter to 71 percent and 21 percent, respectively, as consumers cut spending in all lifestyle areas except for holidays and vacations, traditionally a third quarter expenditure due to summer and school holidays.

Spending on out-of-home entertainment dropped 9 percentage points to 33 percent, compared to 42 percent in the second quarter, and investment in stocks also fell 7 percentage points in the same period. Spending for new clothes and new technology products also fell 5 and 4 percentage points, respectively.

However, Rust was optimistic that consumer confidence in the fourth quarter in Hong Kong can improve when the mainland's economic situation perks up as the Christmas shopping season is coming.

Chong Tai Leung, a finance professor at Chinese University of Hong Kong, said that the local consumer market is still robust despite the negative results depicted by the survey.

"As local residents still have their jobs and pay rise, the fundamental factors supporting the local consumption market are still intact," Chong told China Daily. "May be the fluctuation of the local asset markets has taken a toll on consumer sentiment when the survey was conducted in the last quarter."

oswald@chinadailyhk.com

- Chinese travelers spurring Vietnam's economy

- Disney: China's theme parks drive A-P growth

- Outbound travelers shrug off declines in yuan value

- China's top 10 counties most active in e-commerce startup

- China holds solar energy training for tropical countries

- China's service outsourcing growth picks up

- Fourth China-South Asia Expo concluded

- China encourages local cooperation with Central and Eastern Europe