Draft seeks to simplify pension planning

By CHEN XIN (China Daily) Updated: 2012-11-28 00:54Proposal makes it possible to merge social endowment insurance benefits

Yuan Xiaoqun felt relieved after she heard of a draft policy that would make it easier to deal with her complicated pension accounts.

The 41-year-old Chong-qing resident, whose left leg was broken in a car accident in 2010, worked at a local motorbike parts manufacturer for 10 years, and she paid pension premiums every year.

After the accident, she had to quit her job and joined a new pension program for non-working urban residents.

"Before the new draft regulation, I did not know how to deal with the two insurances I participate in," she said. "But now I can make a wiser pension plan."

The draft regulation Yuan was speaking about was released on Monday by the Ministry of Human Resources and Social Security to ensure conditional transfers of the country's three types of social endowment insurances and to benefit the potential 750 million residents who joined at least one of the three programs.

Those insurances include basic endowment insurance for the urban working group, new rural social endowment insurance for rural residents, and social endowment insurance for non-working urban residents.

At the end of September, the basic endowment insurance covered nearly 300 million people, and the other two covered another 450 million.

With the draft, on which public opinion is solicited until mid-December, the ministry has made clear for the first time that people who have yet to reach retirement age and have contributed to any two or three of those insurances can transfer and combine them into one type of insurance.

People who have contributed to rural or urban residents' insurance can have their premiums in both individual accounts and the government subsidies to combine with their premiums in basic endowment insurance.

But the precondition is that they have worked in cities and contributed to the basic endowment insurance for 15 years, according to the draft.

For instance, farmers who joined the new rural social endowment insurance and later the basic endowment insurance after finding a job in cities can merge the two programs into one basic endowment as long as they pay the premiums for the latter program for at least 15 years.

Endowment insurance is a complicated issue in China, as the premiums people pay and pensions they collect differ among the three insurances, and they also differ from place to place.

In Chongqing, for instance, the individual premium for an employee can range from 107 yuan ($17) to 1,600 yuan a month this year. The premiums for both local non-working urban residents and rural residents range from 100 to 900 yuan a year.

"Each person can only collect pension from one type of endowment insurance after reaching retirement age," the draft says.

Local social security bureaus are asked to accomplish transfer procedures within 45 days after receiving applications, according to the draft.

Ensuring a transfer of different social endowment insurances will help people better decide a more appropriate insurance for themselves, and it will do good to avoid losses in insurance premiums, experts said.

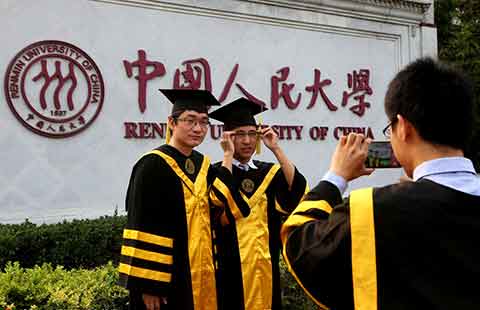

"China has just outlined its social endowment insurance framework for all groups of people, and the new draft mainly gives a signal to the public that everyone can benefit from the social security system no matter when they change from rural residents to corporate employees or urban residents, or from employees to become unemployed," said Lu Quan, a social security expert at Renmin University of China.

Lu Xuejing, director of the social security research center at Beijing-based Capital University of Economics and Business, said: "The draft is quite practical because it will help resolve the problems that many people face when they change their work and living situations, and I believe a large number of people will benefit from it."

She also said a long-term goal for China is to merge all three endowment insurances and provide an equal basic pension fund for all.

"In fact, the new regulation is a key step toward that goal," she said.

Contact the writer at chenxin1@chinadaily.com.cn

- SOE reforms to speed up, target five sectors

- Govt to invest $422b in railways over five years

- China June inflation forecast at 1.9%

- US hardwood exports to China rise

- Suning officially announces takeover of Inter Milan

- China's investment fund industry to continue expanding: report

- More Chinese companies ascend global arena

- China upgrades plan to boost rail network