Hybrid challenge for auto JV in China

By Wang Chao (China Daily) Updated: 2012-11-30 15:42Shifting paradigms force auto joint ventures to focus more on 'made-in-China for China' vehicles

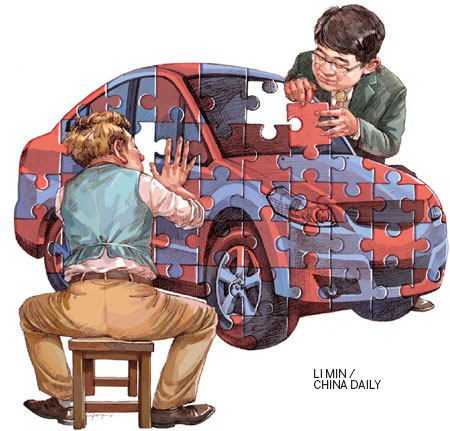

For three decades joint-venture auto companies have ruled the roads in China - with the foreign partner providing the weight of well-known brands and technology and the domestic partner contributing with human resources, production facilities and local knowledge. But a new equation has entered into the relationship: "Made in China for China" vehicles with government encouragement. More and more of these foreign joint ventures are looking to have their own China identity in the form of hybrid variants, rather than piggy-back on the foreign brand to grow sales.

The hybrid brands have not only forged their own IPR, but also capitalized on the strengths of the joint venture partners and used the government incentives to create their own niche in the automobile market. During the first 11 months of the year, out of the 150 new car models that were launched, 74 were China-born brands with a few hybrid variants. Every auto JV worth its salt has launched hybrid vehicles in China to take advantage of this market.

|

|

One reason why the hybrid race appears to be appealing for most of the auto majors is that the products are mainly targeted at the lower end customers, who also account for the lion's share of the market.

Unlike the high-end market where looks and brand name makes the difference, the tipping points in the low, mid and hybrid segments of the market are the pricing and performance, especially factors like fuel efficiency and after-sales service.

Fundamental choice

From a company perspective, having such variants makes sense as they do not put pressure on the existing production lines and can be easily rolled out from platforms that became obsolete after product upgrades.

The trusted and mature production platforms also make it easier for the companies to achieve a higher degree of localization and lower overall costs. Besides, the brands also use the existing distribution network and after-sales services of the joint venture, another factor that helps bring down the overall costs.

Auto industry experts, however, feel that the hybrid trend is an indication that foreign joint ventures are now looking to expand into the lower end of the auto market dominated by Chinese brands like Geely and Chery. The experts feel that it would only be a matter of time before these brands wrest market share from the independent Chinese brands.

Dong Haiyang, vice-president of BAIC, China's fifth-largest auto maker by sales, says that independent auto brands owned by the joint ventures will cannibalize sales from Chinese brands due to their advantages.

Su Bo, vice-minister of industry and information technology, however, feels that hybrid brands have a place in the overall auto market. "Innovation in the auto industry should not be limited to Chinese brands, but include everything that is happening in the industry," he says.

"Only by doing this can we form an equal environment for fair competition and therefore reinforce the innovation skills of Chinese enterprises. If we exclude the foreign partner who contributes to over 80 percent of the investment, it will be a waste of resources."

Having witnessed the ups and downs of the Chinese auto market, many of the joint-venture partners have often found themselves in fricky situations.

The Chinese partner has often found that it did not get access to the cutting-edge technologies from the foreign partners as expected, but instead ended up losing considerable market share to the foreign brand. The foreign partners have found that increased governmental regulation is denting profit margins.

- Vanke A Shares slump by daily limit

- Asia-Pacific head of SAS bullish on China

- China makes bold entry into LatAm health market

- Biopharma, healthcare stocks set for Q3 bounce

- Internet + big data = better service

- Hongkong and Shanghai Hotels preparing to pass the test of time

- Brexit effect eases, rebound likely

- Huaxia Finance CEO wants to give hope to small companies