Li-Ning to raise $241m via convertible securities

By LI WOKE (China Daily) Updated: 2013-01-28 15:01Chinese sportswear giant Li-Ning Co Ltd plans to issue convertible securities to raise up to 1.87 billion Hong Kong dollars ($241 million) to optimize its branding and capital structure.

The company plans to raise about HK$1,847.8 million to HK$1,868.6 million by an Open Offer of Convertible Securities, it said in a statement filed with the Hong Kong Stock Exchange.

"The total gross proceeds from the Open Offer will be used by the group to fund the overall execution of the transformation plan, provide general working capital to the group and to optimize its capital structure," said the company.

Industry experts said Li-Ning has been suffering from inventory problems due to over-expansion in China's sporting goods industry, which is hitting the company's sales and profitability.

"The group's debt level may begin to impact management's ability to make optimal decisions including investments into the group's operations," the company said in the statement.

- Chinese yuan weakens to 6.7690 against USD Monday

- China busts group selling expired New Zealand milk powder

- 89,000 Chinese hold assets worth over 100 million yuan: report

- Netflix wannabes vie for viewers

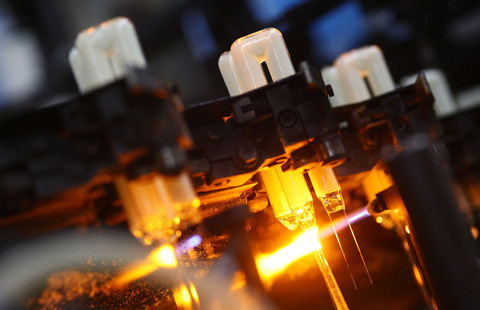

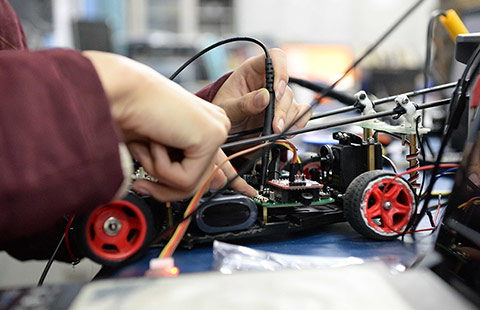

- Universities push the envelope of technology

- China sovereign wealth fund CIC invests in German homes

- Steel giants hit by losses see hope in complementary businesses

- On a big mission to make healthcare accessible to all