Faced with slowing economic growth, retail chains in China are being forced to further improve their management and marketing capabilities to go through the sluggish period, said a report released on Thursday by Deloitte Touche Tohmatsu Ltd.

The report - China Power of Retailing 2013 - reviewed the country's retail industry over the last year, and is based on a survey conducted by Deloitte and the China Chain Store & Franchise Association of 192 retail companies and 108 retail stores in China.

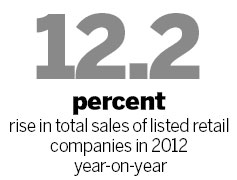

The total sales of listed retail companies rose 12.2 percent year-on-year in 2012, a much slower growth rate than in recent years. Their net profit, which decreased 7.7 percent from 2011, posted the first drop in recent years, said the report.

The sales growth of China's top 100 retail chains eased to 10.8 percent year-on-year, the lowest point in six years.

"The retail industry is facing challenges due to rising operational costs as employee compensation increased and logistics spending continued to rise," said Long Yongxiong, a consumption and transportation industry joint leader at Deloitte China.

At the same time, the booming online retail sector is grabbing market share from traditional retailers with its advantages of lower prices, convenient payment systems and door-to-door delivery, Long pointed out.

Under a major assault from e-commerce firms, the profit margins of the physical retail market in China fell from 5 percent in 2005 to nearly 2.5 percent last year. Tesco Plc, Carrefour SA and Wal-Mart Stores Inc have all remained below that benchmark, a Kantar Retail report said.

"As for single stores, the turnover of foreign retailers is much higher than that of local retail companies in our top 100 retail rankings. I think local retailers have to improve their marketing and operational capabilities to catch up with foreign competitors," said Long.

Still, foreign retailers are also seeing declining sales and are struggling with lackluster conditions in the marketplace.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant