Economists upbeat on inflation outlook

By CHEN JIA in Beijing and YU RAN in Shanghai (China Daily) Updated: 2014-01-10 01:05Eased pressure indicated as CPI stays at 2.6%; industrial deflation persists

Economists expect pressure from inflation to cause no problems this year, following the release of key figures on Thursday.

They said greater downside risks on the overall economy amid tight market liquidity and a heavy debt burden may push policymakers to concentrate on stabilizing growth while pushing forward structural reforms.

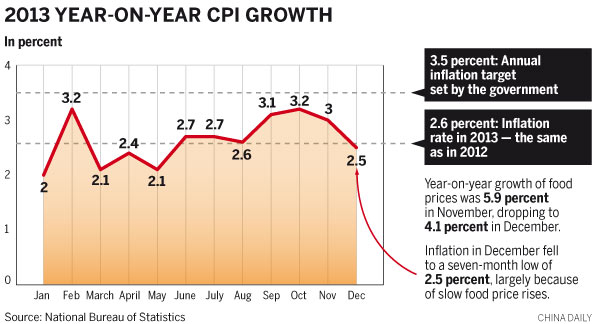

The inflation rate as measured by the Consumer Price Index was 2.6 percent last year, the same as in 2012.

This compares with the annual target of 3.5 percent set by the government at the start of last year, the National Bureau of Statistics said.

The bureau also reported on Thursday that consumer inflation in December fell to a seven-month low of 2.5 percent, down from 3 percent in November and 3.2 percent in October, driven mainly by slow food price rises.

Food prices increased by an average of 4.1 percent year-on-year in December, compared with 5.9 percent in November.

Meanwhile, mirroring the tough economic situation, factory-gate prices of industrial goods fell in December for the 22nd consecutive month in China's longest period of manufacturing deflation since the 1990s.

The Producer Price Index, an indicator of price changes for industrial goods at factory gates, dropped by 1.4 percent in December from a year earlier, the same as in November and slightly lower than the 1.5 percent decline in October, the bureau said.

The figure fell by 1.9 percent year-on-year in 2013, compared with a 1.72 percent drop in 2012.

Weak industrial production may point to an easing of GDP growth momentum, said Chang Jian, chief economist in China at Barclays Capital.

Managers of Chinese manufacturing enterprises have felt the adverse production conditions.

Zhang Guanjin, general manager of Shaoxing Jinyong Textile in Zhejiang province, said export orders fell in 2013 and overseas buyers had much tougher order requirements.

"The company received significantly fewer orders, with nearly 10 percent of regular clients not placing any new orders last year," he said.

Zhang forecasts that current conditions won't improve in the next two to three years because of the slow global recovery and increasing costs for labor and raw materials. He has decided to focus more on expanding in the domestic market rather than externally.

Chang Jian predicts that the GDP growth rate for the fourth quarter is likely to be 7.6 percent, down from 7.8 percent in the third, bringing full-year growth in 2013 to 7.7 percent.

This would be the slowest growth pace since 1990 and just above the 7.5 percent goal set by the government for the year.

Zhang Zhiwei, chief economist in China at Nomura Securities, said, "With the country's leadership comfortable with the current speed of growth, there is no strong incentive to loosen stimulus policy, while low inflation provides more room for policy support when growth slows more sharply, which we expect in the second quarter".

Many economists argued that the low inflation level, especially industrial deflation, reflects sluggish demand and will harm economic growth.

They said the Producer Price Index declines also signal significantly large overcapacity that has emerged in recent years.

However, Louis Kuijs, chief China economist at the Royal Bank of Scotland, said low inflation should not be a worry.

"The recent fall in the PPI is not a surprising or China-specific phenomenon," he said.

"Given the recent behavior of commodity prices on international markets, these downward pressures are likely to persist for a while amid worldwide spare capacity, accentuated by renminbi appreciation."

Xu Hongcai, a senior economist at the China Center for International Economic Exchanges, said that without a new driving force for the economy in the short term, the GDP growth rate may continue to moderate. "We can expect more market vitality to be stimulated by the reform measures, especially in the financial system, and expect high-quality and sustainable development in the long run," Xu said.

Contact the writer at chenjia1@chinadaily.com.cn.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday