Growth pneumatic for German company

By Yao Jing (China Daily) Updated: 2014-01-15 09:28"When I came to Festo, I knew nothing about pneumatic and electrical automation, let alone various complex products," he said.

Still, once you pay enough attention to a new field, things just become much easier, Chen added.

Chen's working days at Festo are always long. He is eager to gain more knowledge about each department and employee.

As an indication of his appetite for hard work, our interview started at close to 9 pm. Chen sipped from a cup of coffee after rushing his dinner. The longtime professional manager then had to attend a meeting after the interview.

Of course, after just one year of learning, Chen cannot be described as an expert at Festo. Being a manager, he said he understands that he needs to know more in a wider sense rather than being thoroughly proficient as technicians in specific production chains.

But when it comes to the transition and further path of the company, Chen's logic is just the opposite.

"We are heading toward being a specialist in our focal majors from being an all-round skilled company covering various areas," he said.

Currently, the most important industry segments for Festo China are automotives, tires and rubber, electronics and light assembly as well as the food and beverage industries, which together account for more than half of the company's sales.

Chen said expanding operations in these sectors is one of the key steps.

Despite facing fierce competition from other automation giants in China, such as Rockwell Automation Inc, Siemens AG and ABB Group that already have a place in the market, Chen is intent on Festo catering to what is a volatile business.

Discussing the current situation of the marketplace, Chen said he is very confident.

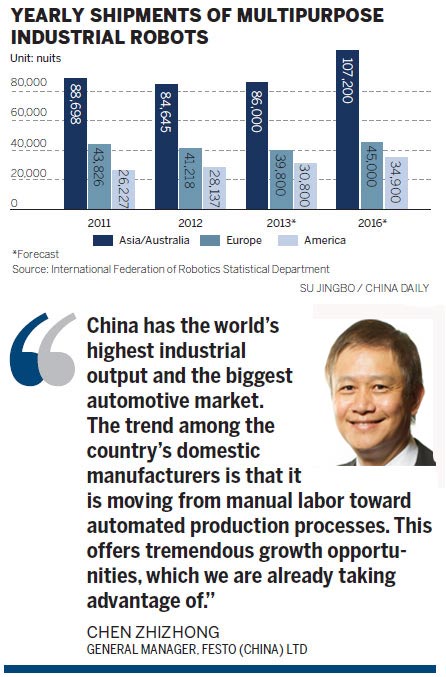

China's industrial robots market will reach 35,000 units in 2015, accounting for 16.9 percent of the global total, according to the forecast of the International Federation of Robotics, an industry alliance based in Germany.

Over the next two years, revenue in the robotics market may reach 1 trillion yuan ($165 billion) in China, the organization forecast.

Meanwhile, Festo has maintained a double-digit growth rate in China for many years. Festo China has also been Festo's biggest market outside Germany in terms of sales since 2009. Total turnover from China makes up more than 10 percent of the company's total sales.

"China has the world's highest industrial output and the biggest automotive market," said Chen.

The trend among the country's domestic manufacturers is that it is moving from manual labor toward automated production processes. "This offers tremendous growth opportunities, which we are already taking advantage of," said Chen.

"In order to save costs for our customers, we have invested much money in our Jinan factory, which is Festo's biggest factory outside Germany. Meanwhile, we are getting closer to the market by moving the manufacturing base to China," said Chen.

As a supplier, Festo is not only aiming to provide solutions for customers but also help customers reduce costs against a background of rising prices of materials and the cost of labor in China to seize a bigger market share.

Faced with whether the movement of the factory will raise suspicions over the brand's quality in that "Made in Germany" is a selling point for its products, Chen said all producing processes in China are strictly in accordance with German standards.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday