The pursuit of balance now begins to pay off

By Gao Changxin in Shanghai (China Daily) Updated: 2014-01-21 14:06The economy grew more balanced last year, with the service sector and inland regions playing a bigger role and the urban-rural income gap narrowing, as the government worked to improve the quality of growth.

The National Bureau of Statistics said on Monday that, for the first time, the service sector played a bigger role in the economy than in industry.

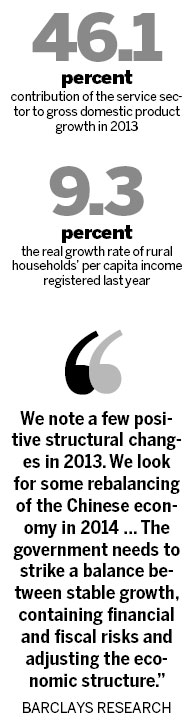

The service sector generated 46.1 percent of GDP in 2013, up from 44.6 percent in 2012. The industrial sector, in comparison, accounted for 43.9 percent of GDP, down from 45.3 percent in 2012.

The less-developed central and western regions accounted for 44.4 percent of the economy in 2013, up 0.2 of a percentage point from 2012, indicating that the east-west wealth gap narrowed.

The average urban income was 3.03 times that of rural residents, falling back from a high of 3.33 times in 2009. That decline accompanied a 1.16 percentage point increase in the urbanization rate last year, to 53.73 percent.

Rural households' per capita income growth continued to outpace that of urban households, with real rates of growth of 9.3 percent and 7 percent, respectively. Migrant workers' real income growth was the fastest, estimated at 10.8 percent.

"We note a few positive structural changes in 2013 ... We look for some rebalancing of the Chinese economy in 2014 amid slower growth," Barclays Plc said in a research note on Monday.

The positive changes come as China commits itself to making structural changes in the world's second-biggest economy. Years of unbalanced growth have resulted in severe industrial excess capacity, regional wealth gaps and asset bubbles, making it hard for the country to continue its growth miracle.

In November, the government unveiled a 60-point reform plan that included financial and fiscal reforms. The nation's leaders said these reforms will have achieved "decisive" progress by 2020, when the economy will grow on a more balanced and sustainable base.

This year is widely considered a key year in determining whether China can succeed with its structural reforms. Analysts expect the government will accept slower growth as it proceeds with its reforms.

Barclays said the Chinese economy faces several major challenges including industrial overcapacity, property bubbles, local government debt, shadow banking and accelerating interest rate liberalization.

Australia and New Zealand Banking Corp expects GDP growth to slow to 7.2 percent in 2014, after 7.7 percent growth in 2013, which would give Beijing breathing room to tackle key economic issues that include excess industrial capacity and an aging population.

"The government needs to strike a balance between stable growth, containing financial and fiscal risks and adjusting the economic structure," said Barclays in a note.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday