Reforms 'good news' for PE, VC firms, say experts

By Cai Xiao (China Daily) Updated: 2014-03-05 09:02Sino-Singapore Investment Fund achieved the highest investment multiple of 20.47. Oriental Fortune Capital from Zhejiang Wolwo Bio-Pharmaceutical Co Ltd was second at 13.67.

According to Fang, the investment return of PE and VC firms is only temporarily in the accounts and their final achievements should be measured on the subsequent condition of the companies in which they invested. Benefiting from a reform plan on new listings released in November last year, existing shareholders can sell shares held for more than three years publicly, so PE and VC investors are able to exit some companies earlier.

For instance, Oriental Fortune Capital, Lehel Capital and Dedonghe Capital transferred their shares in Zhejiang Wolwo Bio-Pharmaceutical Co Ltd.

"The policy is encouraging for PE and VC investors, but buyers are also playing a key role in the success of the transfer trade," said Fang.

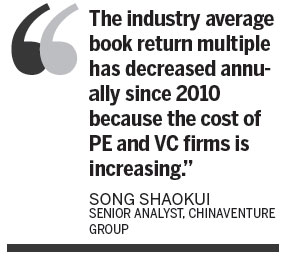

Song from ChinaVenture Group said it is a very good way for PE and VC firms to exit, but many investment deals were made within three years, therefore they did not meet the requirement.

Under the terms of the IPO reform plan, the Chinese Securities Regulatory Commission will only be responsible for examining applicants' qualifications, leaving investors and the markets to make their own judgments about a company's value and the risk in buying its shares.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday