Aiming for both growth and reform

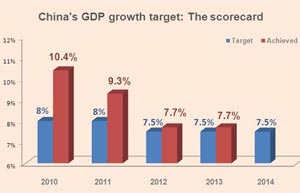

Updated: 2014-03-06 17:25 By Wang Tao (chinadaily.com.cn)The 7.5 percent growth target is achievable, thanks to stronger external demand that is expected from developed economies. However, targeting a relatively ambitious GDP growth will likely limit the space the government has for maneuvering, in its bid to control growth of local government debt and financial leverage, and to push out other serious reforms. Therefore, it is likely that the government will roll out easier and more growth-neutral or growth-enhancing reforms earlier/faster, and proceed with more painful reforms at a relatively slower pace. This is something that had been expected for a while, and hence already priced in into more bullish near-term growth forecast of 7.8 percent. With the China's export recovery far from guaranteed, partly due to China's much-appreciated exchange rate, the government's determination on reform may be tested again later this year if growth slows to about 7.5 percent.

Macro policies will remain neutral

As the key economic objectives remain similar to 2013, the government has kept fiscal and monetary policies broadly unchanged as well. The government is targeting a 2.1 percent of GDP budget deficit, slightly more expansionary than in 2013, likely to accommodate revenue losses from additional tax reforms. On the monetary policy front, the government has kept the M2 growth target unchanged at 13 percent and called for "stable" monetary and financial conditions and "appropriate" growth in total social financing (TSF). Considering that infrastructure investment is likely to slow and the less credit-intensive exports and consumption are expected to recover, the unchanged M2 growth target seems relatively accommodative.

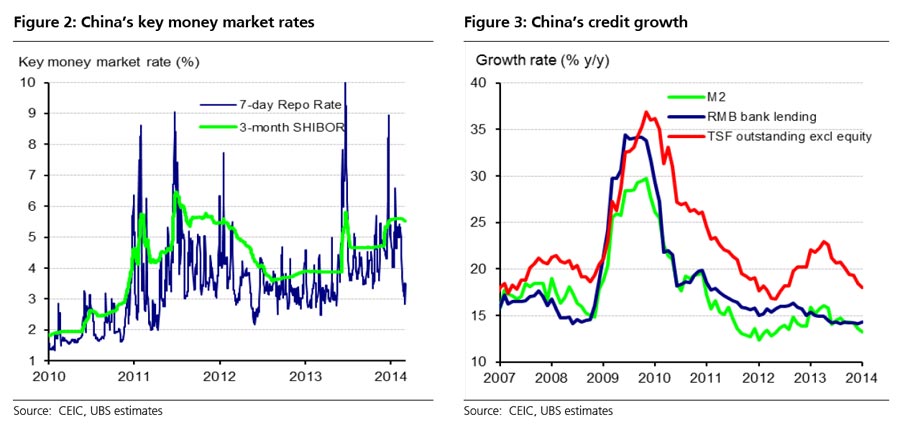

Will this mean tighter or looser monetary policy from where we are? In terms of interbank rates, clearly the recent low short-term rates following the Chinese New Year are not sustainable, and may have reflected inadequate liquidity withdrawal by the central bank rather than intended policy easing. The 7-day repo rates are expected to average 4-4.5 percent for 2014, a level lower than at the end of 2013 but higher than in recent days (Figure 2). The yuan loan growth is projected to slowdown to 13 percent and TSF growth to below 16 percent as the PBOC tries to lower the pace of leveraging in the system (Figure 3). However, in light of the unchanged M2 growth target, there is a risk that credit growth may not slow by as much as expected in 2014, even though market has been concerned that regulations on shadow banking and higher interbank rates may lead to a sharp deceleration in credit growth.

There seems to be no major policy changes this year regarding the property sector, which should somewhat ease market concerns on the subject. The new government has not stressed regular property tightening since last March, and this year's NPC report continues to focus on the provision of social housing and sufficient supply of affordable housing in the near term. The government raised its social housing targets slightly this year, with an aim to start seven million units (of which 4.7 million are slum renovation) and complete 4.8 million units. It reiterated its practice of curtailing "investment demand" in certain cities – suggesting that the current purchase restrictions in large cities will remain. A property tax is also not expected in the near future – this year's government plan is still to "accelerate the legislation regarding property taxes".

|

|

|