Shadow banking offers no cause for alarm: Experts

By Hu Yuanyuan (China Daily) Updated: 2014-03-07 08:19

|

|

|

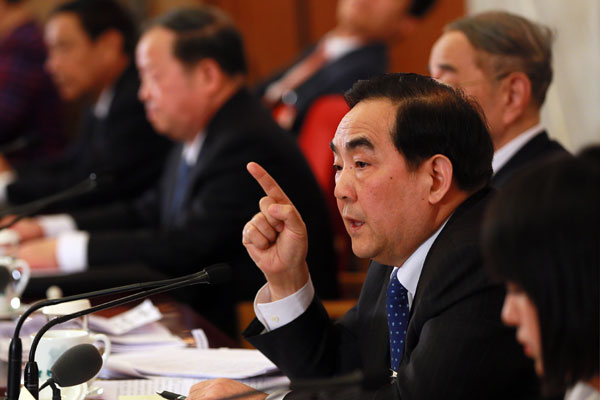

Yang Kaisheng, CPPCC member and former chairman of the Industrial and Commercial Bank of China, answers questions at a news conference on Thursday afternoon. Zou Hong / China Daily |

Leverage in sector remains low due to China's limitations on derivatives

China's banking sector remains solid, with the shadow banking sector well under control, Yang Kaisheng, former chairman of Industrial and Commercial Bank of China, the country's largest lender, said on Thursday.

By the end of 2012, China's shadow banking sector accounted for about 10 percent of GDP, while the figure in the US was 150 percent, according to Yang, a CPPCC member.

|

|

Shadow banking is a term for the collection of non-bank financial intermediaries that provide services similar to traditional commercial banks.

The recent default crisis that affected several Chinese trust companies triggered concerns about the country's shadow banking, and some economists worried that it could lead to a possible financial meltdown.

In the latest case, Jilin Province Trust, which raised 1 billion yuan ($162.5 million) to invest in a private coal miner in north China's Shanxi province, told its clients that it had no repayment timetable as the debtor itself was mired in debt.

The trust company missed payments for five tranches. The sixth is due to mature March 11. That followed a similar product default by China Credit Trust Co in January.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday