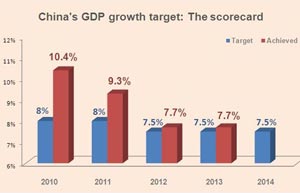

Good year-end 'to secure 7.5% growth target'

By Zheng Yangpeng (China Daily) Updated: 2014-03-10 01:08Another concern among economists is that growth will be dragged down by slowing investment, because fixed-asset investment accounted for about half of the country's growth in the past few years. The NDRC's report this year has already lowered its expectation for fixed-asset investment to 17.5 percent, down from 18 percent a year ago.

Song acknowledged there are many negative factors in investment, including a glut of capacity in some industries, and rising borrowing costs. But he also pointed out a number of "bright spots" for investment.

One is the fast growing investment in strategic and emerging industries, such as biotechnology, new materials and alternative energy.

For traditional industries, there is also enormous demand for technological renovation and equipment upgrading.

In the long term, the rising of information technology and the service sector is also one of the bright spots, Song said.

For the property sector, he said demand remained robust in many county-level cities as massive numbers of migrant workers, after earning money in large cities, buy houses in their hometowns.

Separately, the consumer price index, a main gauge of inflation, increased 2 percent year-on-year in February, down from 2.5 percent in January, the National Bureau of Statistics said on Sunday.

|

|

|

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday