UBS cuts 2014 China CPI forecast to 2.7%

By Tao Wang and Harrison Hu (chinadaily.com.cn) Updated: 2014-03-11 17:06Lower commodity prices the biggest contributor to the decline in PPI

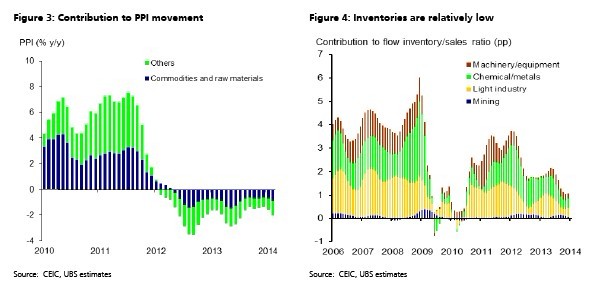

The drop in commodity (mining products) and raw material prices has directly contributed to nearly half of the 1.9 percent decline in China's PPI in the past year. Prices of other investment goods are also heavily influenced by the costs of raw materials and inputs, apart from the economic cycle which affected demand. During January-February 2014, general economic activity but especially investment activity was usually sleepy, weaker than the same period in 2013 when a prelude of strong credit growth had pushed up growth outlook and restocking activity. Consequently, raw material prices fell more steeply in the past two months. Consumer goods prices within the PPI also declined in Jan-Feb by 0.3 percent, though entirely driven by the drop in food prices.

No need to worry about full scale deflation

Should we worry about persistent decline in PPI delaying corporate investment, transmitting to CPI and cause full scale deflation in China in the coming year?

Not really.

On the producer goods front, the decline in prices of commodities and raw materials contributed the bulk to the decline in PPI, but that is arguably not malign deflation. Raw material prices will unlikely decline perpetually – to the extent some hard commodity prices may fall further due to a large increase in supply, it is good news for China as the largest consumer and a big net importer. The yuan appreciation against the US dollar has also helped to depress import prices of commodities and raw materials in the past year. In fact, the gap between overall factory gate price inflation (PPI) and input costs has stayed stable in recent months, even expanding marginally in the Jan-Feb period.

The existence of excess capacity in some sectors may have depressed and may continue to weigh on some producer goods prices. However, demand has been relatively stable and is expected to pick up, inventory levels are relatively low in most sectors (Figure 4); and the government's effort to retire excess capacities should also help contain supply.

On the consumer price front, the food component was the main reason behind the weakening in both the CPI and PPI consumer goods inflation in recent months. Core manufacturing goods price inflation has remained stable at one to two percent.

Looking forward, the continued near double digit wage growth may put upward pressure on services and many manufacturing goods prices and prevent a full-scale deflation. In the next couple of years, prices of energy, transport and utilities will be raised steadily as part of the factor price reform, which should also help to limit the fall in PPI inflation.

|

|

|

The authors are economists of UBS Securities Asia Limited, an affiliate of UBS AG. Their views do not necessary represent those of China Daily.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday