Waiting game for action on economic solutions

By Ed Zhang (China Daily) Updated: 2014-03-24 07:34After the January-February data, investors can't be optimistic about China's GDP growth in the first quarter of the year.

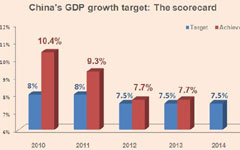

Some economists forecast that it will go down from 7.7 percent in the fourth quarter of 2013 to 7.6 percent. There is a likelihood that the figure can be lower.

|

|

For the whole year, China would do well to achieve 7.2 to 7.3 percent growth, because that would be close enough to its yearly target set at 7.5 percent.

In his news conference on the closing day of the recent annual session of the National People's Congress, Premier Li Keqiang clearly indicated that so long as the urban employment situation allows, the Chinese government can tolerate slightly lower GDP growth and that it is not obsessed about numbers just for their sake.

The slowdown in China's growth is only natural following its export-led growth peak around the Beijing Olympics in 2008, which was soon interrupted by the financial crisis in the US and then the debt malaise in the eurozone.

The government dealt with this catastrophic turn in the market with a massive credit stimulus (4 trillion yuan, about $600 billion, from the central government alone) and lifted growth rate back into the 10 percent-plus range, at one point even higher than the highest point in 2008.

Such a bailout program, in hindsight, was an over-reaction by a newcomer in the global market unprepared to see such an abrupt change.

In some cases, it was little more than an effort to keep bailing out the same industry making the same products that a changing market no longer had as much demand for as before.

Small wonder then that overcapacity has become such a rampant disease, especially in industries featuring high demand for resources, low profit and severe pollution. Growth of such a kind would have been unsustainable, if not suicidal.

So, the slowdown since 2012 (GDP growth has remained under 8 percent since) can only be seen as a return to the normal - perhaps only the beginning of the return, because although China has managed to shed some overcapacity in the last couple of years, it is still a long way from striking an ideal strategic rebalance.

Half, if not more, of the country's industry would have to be phased out or go through a major overhaul in several years when the economy is trying to adapt to new trends in the world, according to China's younger and tech-savvy business commentators.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday