Reform a must despite challenge

By Xin Zhiming (chinadaily.com.cn) Updated: 2014-04-10 12:10Premier Li Keqiang ruled out the possibility of any strong stimulus measures to raise China's GDP growth on Thursday at the Boao Forum. The decision will help the market come to reasonable expectations on China's economic bail-out moves and is a reflection of China's unchanged reform-oriented policy stance.

|

|

|

|

Despite Li's assurance that the Chinese economy remains resilient, the market has widely anticipated weak performance from the world's second-largest economy amid turbulent global situation. Investors have been awaiting for signs of China taking further stimulus moves, as a string of indicators have shown the economy is encountering difficulties.

China has released new policies to boost economic growth last week, including preferential tax policy and increased infrastructure investment, a move that is taken as mini-stimulus. It is far smaller in scale compared with the major stimulus measures during the 2008 global financial crisis.

Li's latest remarks have made it clear that there would not be strong stimulus measures, a stance that will help anchor market sentiment and prove more constructive in restructuring the Chinese economy in the middle and long term.

Indeed, the economy has been trapped in difficulties. In the trade sector, China's exports fell 6.6 percent in March year-on-year, according to the latest official data released on Thursday. Imports also fell, down by 11.3 percent year-on-year. Both fall short of market expectations.

Trade, industrial output and retail sales figures in the previous month also pointed to a weak growth momentum.

But China cannot afford taking major short-term stimulus measures whenever challenges arise.

The legacy of the 4-trillion yuan ($645 billion) stimulus five years ago remains a factor thwarting China's much-needed economic reform and restructuring. Another round of major stimulus would only make things worse.

The top leadership has been determined not to continue that sort of stimulus-based game. And there's some room for sticking to the reform agenda.

As Premier Li rightly pointed out at the Boao Forum, China can afford a real GDP growth rate that is lower than the target of 7.5 percent for this year, so long as it does not deviate too far from the target and employment situation remains stable.

Based on inflation, employment and income indicators, which are yet to see significant changes for the worse, it is reasonable — actually it is a must — for China to continue its reform steps to unleash the long-term growth potentials of its economy.

Such a policy stance may not provide much boost to growth in the short term, but it is indispensable if China wants to remain competitive in the future.

|

|

| Premier Li meets with Namibia's PM |

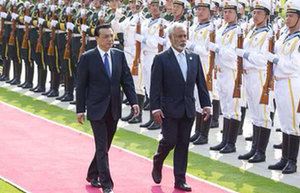

- Premier Li talks of Asia's economic integration

- Asia should explore establishment of security co-op framework

- Reform a must despite challenge

- Li proposes 'common community for Asia'

- Li attends opening ceremony of Boao Forum

- Li vows to wrap up RCEP talks

- Li stresses flexibility in 'reasonable growth range'

- China seeks early launch of Asian bank: Li