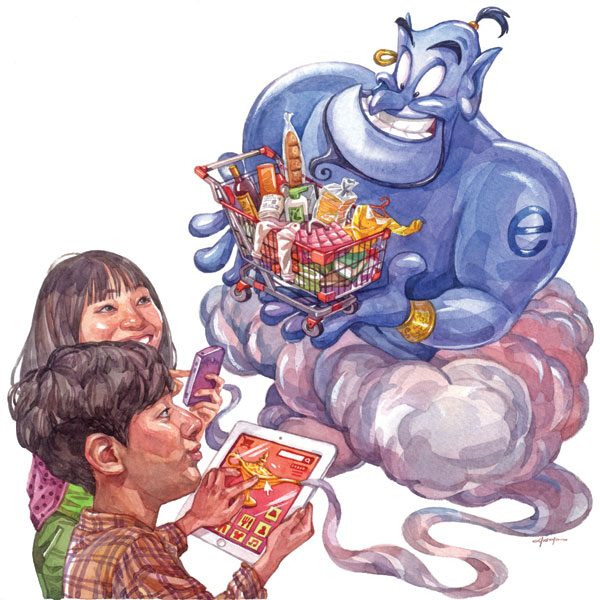

Click profit

By MENG JING (China Daily) Updated: 2014-05-26 07:42

|

|

LI MIN/CHINA DAILY |

Bustling e-commerce market creates new growth opportunities for overseas companies in China

British retailer Burberry Group would never have imagined that its scarves and trench coats would be sold from virtual stores in China. But the iconic luxury brand and other biggies like Marks & Spencer Plc, Mothercare Plc, Nike Inc, Levi's Strauss & Co and Sony are increasingly finding that having an online presence is essential for continued success in China.

For most of these companies, the online attraction is understandable: surfing the Internet is not only the favorite leisure activity for young people in China but also the main influencer of purchasing decisions. Physical risks and costs associated with setting up stores have also prompted many of these companies to build their online presence.

In April, Burberry opened a virtual store on Tmall, the biggest business-to-customer site in China, and now offers a wide array of items, ranging from woolen scarves priced at 4,000 yuan ($640) to high-end trench coats called Heritage, priced at 17,500 yuan.

Though Burberry is the first pure luxury brand to join Tmall, the platform has already attracted more than 70,000 sellers. British fast-fashion retailer ASOS has also established a store on Tmall to supplement its existing outlet in China. While it's still too early to gauge whether Burberry would reap gains in the long run, there is no doubting the huge growth potential of China's e-commerce market.

Growth rates typically represent the true appeal of any industry. The e-commerce industry has been no exception and has clocked consistent growth rates of over 70 percent in China since 2006.

Last year, Chinese shoppers purchased 1.8 trillion yuan worth of goods online, which means that 7.9 percent of the country's total retail trade was conducted over the Internet.

Industry experts, however, say that Chinese e-commerce platforms have played a big role in shaping consumer preferences. They point out that though e-commerce sites such as Taobao and Tmall were initially used by Chinese consumers to leverage pricing advantages, the platforms have now become more sophisticated. E-commerce platforms are focusing more on branding and product qualities and this has benefited multinational firms, they say.

Carrie Yu, a partner specializing in retail and consumer practice with the global consultancy firm PriceWaterhouseCoopers in Hong Kong, says it's an opportune time for tapping the e-commerce potential of China.

- Feast your eyes on aeroplanes as festival takes off

- Fresh bid to build charging network

- Poland's branding in need of polishing

- China's SME board sees fast growth

- The multibillion-dollar house that Jack built

- China's housing market going through natural adjustment

- Silk Road economic cooperation to bring benefits

- Click profit