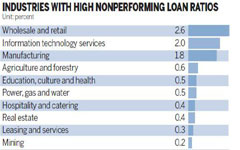

CBRC warns lenders of joint loan risks

By Jiang Xueqing (China Daily) Updated: 2014-05-30 06:59Shaky companies can drag down solvent ones, regulator says

The China Banking Regulatory Commission is strengthening its efforts to oversee joint-guarantee loans for fear risk will be transmitted from one company to another if the Chinese economy keeps slowing down, Reuters reported.

|

|

|

E-mailed questions sent to the CBRC were not answered by press time.

Joint-guarantee loans used to be regarded positively, as one company helping another to overcome financial difficulties, but in recent years, it was found during a liquidity stress scenario that a well-managed company with good capital flow can become burdened by other companies' problems, said Zong Liang, researcher at the Institute of International Finance under the Bank of China Ltd.

- China seeks to groom "fuerdai" into business leaders

- China's machinery industry sustains mild recovery

- All eyes on pig exchange rate

- China allows private investment in army equipment

- Chinese banks advised to target retail banking

- China's service sector opening to foreign investment

- Weakest link will determine success of muni reform

- Guangdong helps kick off new era