Offshore gold contracts to be traded in FTZ

By Wu Yiyao in Shanghai (China Daily) Updated: 2014-06-05 06:51Offshore gold contracts denominated in renminbi, the Chinese currency, will be traded in the China (Shanghai) Pilot Free Trade Zone later this year, top officials of the Shanghai Gold Exchange said on Wednesday.

The People's Bank of China, the central bank, had in May given the green light for setting up an "international

|

|

SGE officials indicated that the plan to accept offshore renminbi-denominated investments will speed up the Chinese currency's internationalization process and make the Chinese bullion market more accessible to overseas investors.

SGE is the world's largest physical gold exchange and handles most of the gold transactions that take place in China.

The central bank statement had indicated that the various categories of gold being traded at the SGE would also be made available on the international board. SGE officials said that most of the preparations are in place and the bourse remained confident of starting trading at the FTZ by the end of the year.

Registration of the Shanghai Gold International Exchange, technical preparations and recruitment of international members would be completed by the end of the third quarter.

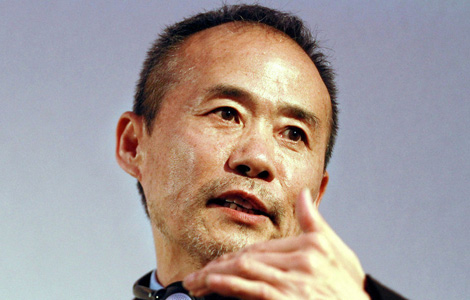

Xu Luode, head of SGE, indicated that Shanghai will now play a much bigger role in the international bullion market, adding that the international board and the SGE would follow the same pricing mechanism.

"As trading volumes pick up, the FTZ will have a much bigger role globally. Shanghai may become the third - largest international gold trading hub after New York and London," said Xu.

|

|

- FTZ strengthens Shanghai logistics

- Financial Valley, FTZ attend Beijing Fair

- Shanghai FTZ ready to spread its model nationwide

- Shanghai FTZ ready to spread its model nationwide

- Complete legal system will benefit FTZ, experts say

- China world's biggest gold market

- Global gold jewelry demand increased 17% in 2013

- New Year's money made of gold

- Russia, China inch toward another gas contract

- Changing dynamics in housing market 'normal'

- Offshore gold contracts to be traded in FTZ

- Qingdao Port: Shipments unaffected by investigation

- New credit ratings agency in the works

- E-commerce potential still robust in most Chinese cities

- Sino-US business ties still 'positive'

- Guangdong kicks off effort to spur foreign trade