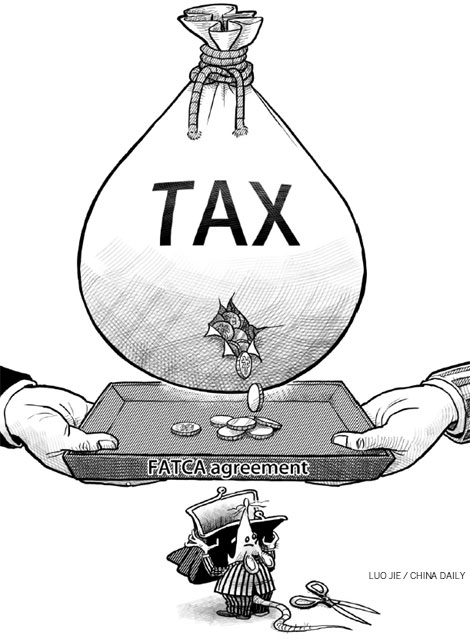

Tax deal heralds better Sino-US ties

By Mike Bastin (China Daily) Updated: 2014-07-03 07:41

The recent agreement between the United States and China to implement a new US law aimed at penalizing overseas Americans for evading tax should be welcomed, because it will generate many economic benefits. For example, the inter-governmental agreement (IGA) will also enable Beijing to get information on Chinese taxpayers in the US and help it bring tax evaders to justice.

Long seen as a crucial step for the rollout of the 2010 Foreign Account Tax Compliance Act, the agreement with China in substance was concluded just days before the law took effect on July 1. The US now has FATCA agreements with more than 80 economies. FATCA agreements require foreign banks, investment funds and other financial institutions to inform the US government about Americans who have more than $50,000 in their accounts.

|

|

|

The China-US IGA, however, has implications that transcend the fields of international finance and economics. For one, it marks another positive development in Sino-US political relations.

Also, the IGA comes on the heels of Premier Li Keqiang's visit to the United Kingdom and Greece, during which trade deals worth about $30 billion were signed. It can thus be seen as another significant example of improving relations between China and the rest of the world.

Specifically, relations between the Chinese and US governments have not progressed smoothly in recent years, with both sides accusing each other of industrial espionage. Hopefully, the IGA will pave the way for more cooperative, mutually beneficial, inter-governmental dealings.

But that is possible only if the US government wakes up to the realization that engagement with China is the way forward and that business and trade deals with it will prosper only if inter-governmental relations are satisfactory, if not excellent.

- China's rural areas outpace cities in online shopping

- Tianjin to boost trade ties with Taiwan

- Chinese banks given yuan exchange freedom

- Tax deal needs framework

- Tax deal heralds better Sino-US ties

- Capital market reform catalyst for China's restructuring

- China approves NE China pilot zone

- World's 'tallest' tower a watermelon field