Singapore's wealth fund increases China holdings

By Zheng Yangpeng (China Daily) Updated: 2014-07-09 07:15

|

|

A receptionist stands behind a logo of state investor Temasek Holdings at their office in Singapore July 8, 2014. [Photo/Agencies] |

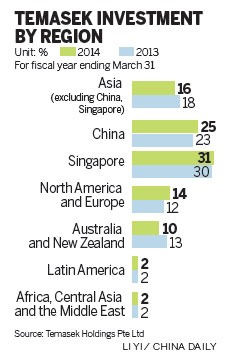

Temasek Holdings Pte Ltd has increased its exposure to Chinese markets over the past year, even as Asia holdings weighed on its performance and the Singaporean investor turned to the West for growth.

The sovereign wealth fund's holdings of China assets rose to 25 percent in the fiscal year that ended March 31, up from 23 percent year-on-year, according to a statement it released on Tuesday.

China continued to be the top destination for Temasek's global portfolio after Singapore, which accounted for 31 percent of its portfolio.

Ding Wei, head of operations at Temasek China, told China Daily recently that the firm recognized the increase in consumption and ongoing urbanization in China, and is "still confident in China's economic potential" despite its current slowdown. Temasek was not immediately available for comment about its latest report.

Over the past fiscal year, the fund has increased its stake in Industrial and Commercial Bank of China Ltd to 8.9 percent of its H shares (equivalent to 2.2 percent of total ICBC outstanding shares), the statement said. It completely exited its investment in Youku-Tudou Inc, a Chinese video-streaming site.

Temasek's stake in China Construction Bank Corp accounted for 8 percent of its total portfolio value as of March 31, 2013, and is among its top three financial sector exposures. It did not mention any change in investments in CCB in Tuesday's statement.

Globally, it neither increased nor decreased its exposure in Asia ex-Singapore, though the region still accounted for half of its S $24 billion ($19.3 billion) in new investment dollars.

But it has raised its exposure in North America and Europe to 14 percent from 12 percent amid their economic recoveries. In a sign of increased interest there, the two regions accounted for about 40 percent of new investment over the past year.

"In the course of the past year, the United States tapered its loose monetary stance, and China reined in its debt-fueled growth. This bodes well for the longer term, though major central banks will most likely take years to unwind their massive balance sheet expansions of the past five years," Temasek Chairman Lim Boon Heng said in the statement.

Due to weakness in key Asian markets last year, the value of Temasek's holdings increased by only 3.7 percent to S $223 billion. By comparison, growth tallied the previous fiscal year was 8.6 percent.

Total shareholder return for the past year also shrank to 1.5 percent from 8.9 percent year-on-year. The firm's total shareholder return averaged 16 percent since inception in 1974.

- China to accelerate treaty with US: Xi

- China's June PPI down 1.1%

- Climate change new engine of China, US ties

- Animal-shaped trees a cash cow for farmers

- Cabinet unveils guideline to ensure fair competition

- China's inflation grows 2.3% in June

- China's online clothing sales to reach 615b yuan

- Insurance premiums to cover 5% of China's GDP: report