Concerted efforts can help boost growth

By Ed Zhang (China Daily) Updated: 2014-07-21 07:15A couple of other national projects can always be embarked upon whenever exports flag or consumer spending fails to generate enough growth. The announcement of such projects can trigger an almost immediate reaction from the stock market - companies that are likely government suppliers start issuing new shares.

Such a trigger effect, in contrast, has yet to be seen for reforms. Many policies that are supposed to help China's long-term growth have been announced by the central government since late 2013. But quite a few have remained only on paper because of resistance and inaction from local bureaucracies.

The ongoing anti-corruption campaign has a serious limitation: It can do nothing about the officials who don't take bribes, don't have unreported income from businesses, or don't keep mistresses, but just don't do their jobs under the sympathy-inducing pretext that they don't want to make any more mistakes.

Not a single one of the central-level state-owned enterprises has made progress in any area enumerated by the reform program that the top leaders adopted last November.

It was only a week ago that a few committees were set up under the State-owned Assets Supervision and Administration Commission to experiment with some of the reform ideas at a few companies. By the time any reform is actually launched, as one can imagine, it would have taken another half-year. Given that timeline, it would take one more year, at least, for any of the reforms to bear fruit.

Is there any way to speed up reform and to somehow force the SOEs to show more action? How about ways to boost the growth of a new, more innovative and globally competitive block of the economy?

These questions remain unanswered while China is generating new growth.

The author is editor-at-large of China Daily.

|

|

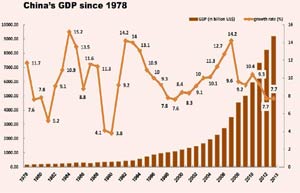

| China's H1 growth up 7.4%, showing economic resilience |

|

- China Unicom's mobile subscribers grow 0.6% in June

- China's June forex purchase likely to rebound

- Waning lock-up shares eligible for trade

- Meat supplier of McDonald's, KFC suspended

- A land of rich pickings

- China Development Bank opens office in Venezuela

- Urumqi boasts first marsh gas power plant

- Villagers turn to smartphones, blogs to promote harvest